There was a time when even a million bucks sounded like an impossibly huge amount. But Reliance Industries Limited (RIL) rewrote the script, becoming the first Indian company to cross a mind-boggling ₹20 lakh crore in market capitalization. That’s a number so significant that writing it numerically will be a task to read! And it also deserves a closer look.

So, how did this oil and gas giant, once known for its petrol pumps, reach such dizzying heights?

From Barrels to Bytes

RIL’s journey wasn’t always about high-speed internet and streaming subscriptions. Its roots lay deep in the oil and gas industry, where it became a significant player. However, the company underwent a bold transformation under Mukesh Ambani’s leadership.

Jio, the telecom arm, became a game-changer, disrupting the market with affordable data plans and sparking a digital revolution in India. Reliance Retail, already a household name, further expanded its reach, offering everything from groceries to electronics.

These weren’t just random moves. They were calculated bets on emerging sectors and changing consumer preferences. Jio, for example, capitalized on India’s growing mobile phone user base and their thirst for affordable data. This move disrupted the telecom landscape and created a massive digital ecosystem for RIL, paving the way for further expansion into e-commerce and entertainment.

Riding the Waves of Opportunity

RIL’s success wasn’t just about internal transformations. The company also skillfully rode the waves of external trends. India’s booming economy and rising disposable incomes fueled demand for its diverse offerings. The government’s push towards digitalization further fuelled Jio’s growth.

RIL’s smart investments in renewable energy also positioned it as a leader in a sector with immense potential. RIL ensured its long-term sustainability and investor confidence by diversifying its portfolio and staying ahead of the curve.

Past Performances: A Track Record of Success

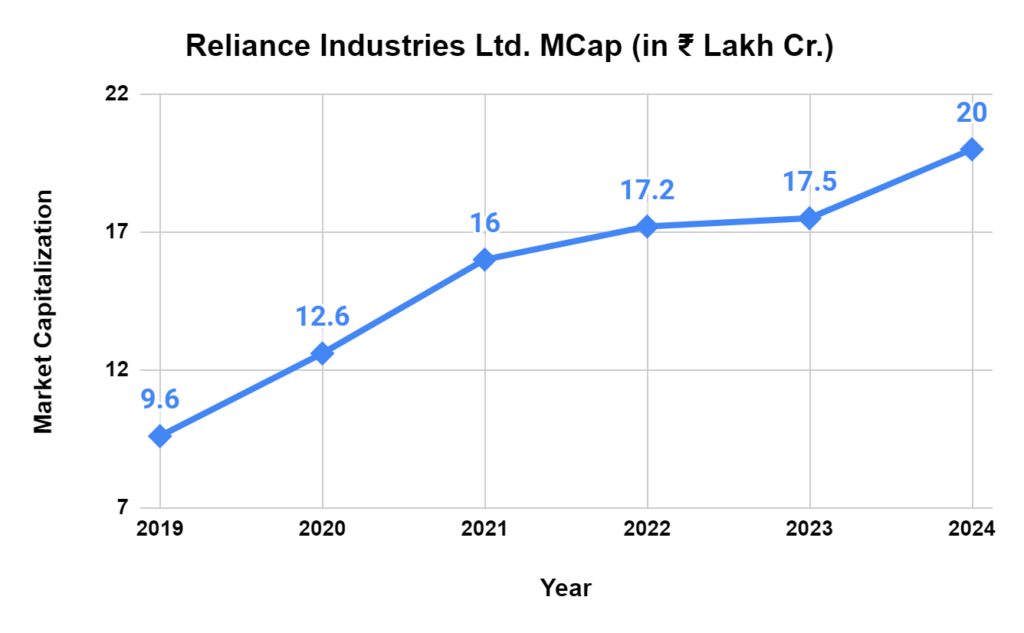

Reliance Industries Limited’s market capitalization (MCAP) has shown consistent growth over the past five years, experiencing a remarkable 104% increase from 2019 to 2024. While the growth wasn’t linear, the company saw significant jumps in 2020 (32%) and 2021 (27%).

Although the growth slowed in 2022 and 2023, it remained steady at around 2.5%, culminating in a further 14% increase in 2024 to reach the historic 20 lakh crore mark.

Beyond the Numbers: The Impact and Significance

RIL’s achievement is more than just a financial milestone. It serves as a testament to India’s growing economic prowess and the potential of its homegrown companies. It inspires other businesses to think big, innovate, and diversify, paving the way for a more vibrant and competitive Indian economy.

What’s Next for RIL?

As per a Bernstein report, a robust 20% CAGR is expected in EPS growth until the end of FY26. This optimism is driven by two key sectors:

1. Retail: On a tear with a 24% year-on-year growth, this segment is expected to be sustainable through store expansion and increased e-commerce penetration.

2. Telecom: After the 5G rollout, the focus will shift to monetization, with Jio’s revenue expected to grow at a 15% CAGR for the next three years. By FY25, Jio’s market share is projected to reach 47 percent, fueled by 500 million subscribers and an over 11 percent tariff hike.

While RIL’s oil-to-chemical earnings might remain flat due to stagnant volume growth, the future looks bright for its renewable energy investments, with solar and battery capacity expansion driving future growth.

Looking Ahead

Reaching the ₹20 lakh crore mark is a remarkable achievement, but it’s not the end of the story. RIL’s ambitions are far from over. The company continues to invest heavily in new technologies like 5G and green energy, aiming to solidify its position as a leading player in these crucial sectors. With its track record of innovation and strategic thinking, RIL is poised to continue its growth trajectory, setting new benchmarks and shaping the future of Indian business.

So, the next time you hear about Reliance, remember – it’s not just a company; it’s a symbol of India’s economic aspirations, reaching new heights and inspiring others to do the same.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

Know more about

SIP CALCULATOR | RETIREMENT CALCULATOR | CAGR CALCULATOR | FINANCIAL CALCULATORS

How useful was this post?

Click on a star to rate it!

Average rating 3.3 / 5. Vote count: 8

No votes so far! Be the first to rate this post.