Taper tantrum is an often used phrase whenever the US Fed talks of increasing interest rates. Everyone, especially investors, start considering the consequences of such an action. In most cases, investors panic when the stock markets become volatile. Market sentiments become negative, adversely affecting investor wealth.

However, veteran investor Mark Mobius continues to remain bullish on Indian equities. In a recent interview, Mark Mobius said, “interest rates don’t affect Equities much.”

Are you wondering how when you’ve always thought high-interest rates mean low liquidity and less spending? Mark says, “interest rates have a significant impact on fixed income instruments.” When markets are volatile, investors move their money to safer assets. An increase in the interest rates is an added advantage for them. Similarly, low-interest rates deter investors from shifting their money to fixed income instruments.

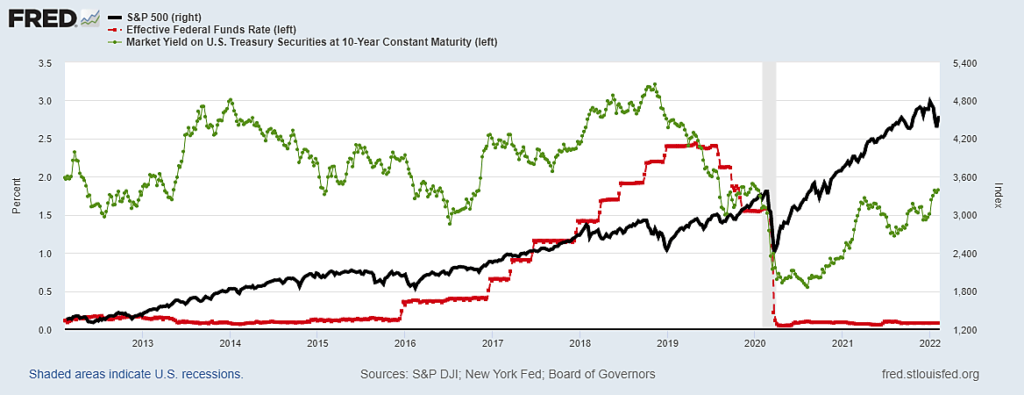

Needless to say, an interest rate hike could lead to a short-term correction. However, the impact of this action may not be the same in the long term. For example, look at the relation between S&P500 and Fed rate hikes between 2017 and 2019. You will find Fed rates went up, but the market remained flat or slightly high. Later, the S&P500 continued moving up even when the rates came down.

There can be many reasons a market reacts negatively or positively to interest rate hikes. One such reason could be bond yields. Higher bond yields reduce the price-earnings multiples for stocks in the short term.

Another reason could be the long-term bond yields rising marginally even when interest rate hikes push short-term bond yields higher, thereby flattening the yield curve.

Significant changes in the long-term interest rate affect PE multiples. High-interest rates reduce the discounted present value of expected but uncertain future earnings. However, an increase doesn’t mean the bond yields will rise; they could also fall, making investors believe income growth could slow down.

You may think, Mark as well as the chart explains the scenario for the U.S. markets. Will the same narration be true for the Indian markets, too?

Most probably yes. India being an open and an integral economy in the world, the domestic markets do take cues from its foreign peers, which means, NIFTY and Sensex more often than not move in the direction of global indices.

The comparison may not be point to point. For instance, if S&P 500 falls 5%, NIFTY may correct 7% within a similar time frame. To check it yourself, look at the five-year trend of S&P 500 and NIFTY on Google, you will find identical curves for both the indices.

We can safely assume the stock market is not as sensitive to the Fed interest rate hikes as investors believe. Unless the government policies slow down the economy and financial growth, the stock market is the best place to earn long-term returns.

What do you think of this article? Let us know on createwealth@researchandranking.com

In the meantime subscribe to 5 in 5 Wealth Creation Strategy and start earning long-term returns.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.