As a parent of a differently-abled child, you may face unique challenges and expenses in providing them with the best care and support. That’s why a sound financial plan covering your child’s present and future needs is crucial.

There are many expenses that we must foresee to have smooth sailing. In challenging cases, just the medical cost for the child’s requirements can range anywhere between Rs 2 lakhs to Rs 4 lakhs.

Here are some tips and options on planning and investing for your differently-abled child’s financial well-being

Assess your child’s needs

The first step in creating a financial plan is to assess your child’s current and future needs. This may include:

- Special education and therapy costs

- Medical and health care expenses

- Assistive devices and equipment

- Daily living and personal care expenses

- Future income and employment prospects

- Long-term care and support

You may need to consult with various professionals, such as doctors, therapists, educators, and lawyers, to get a clear picture of your child’s needs and the associated costs.

Avail of Government Benefits and Schemes

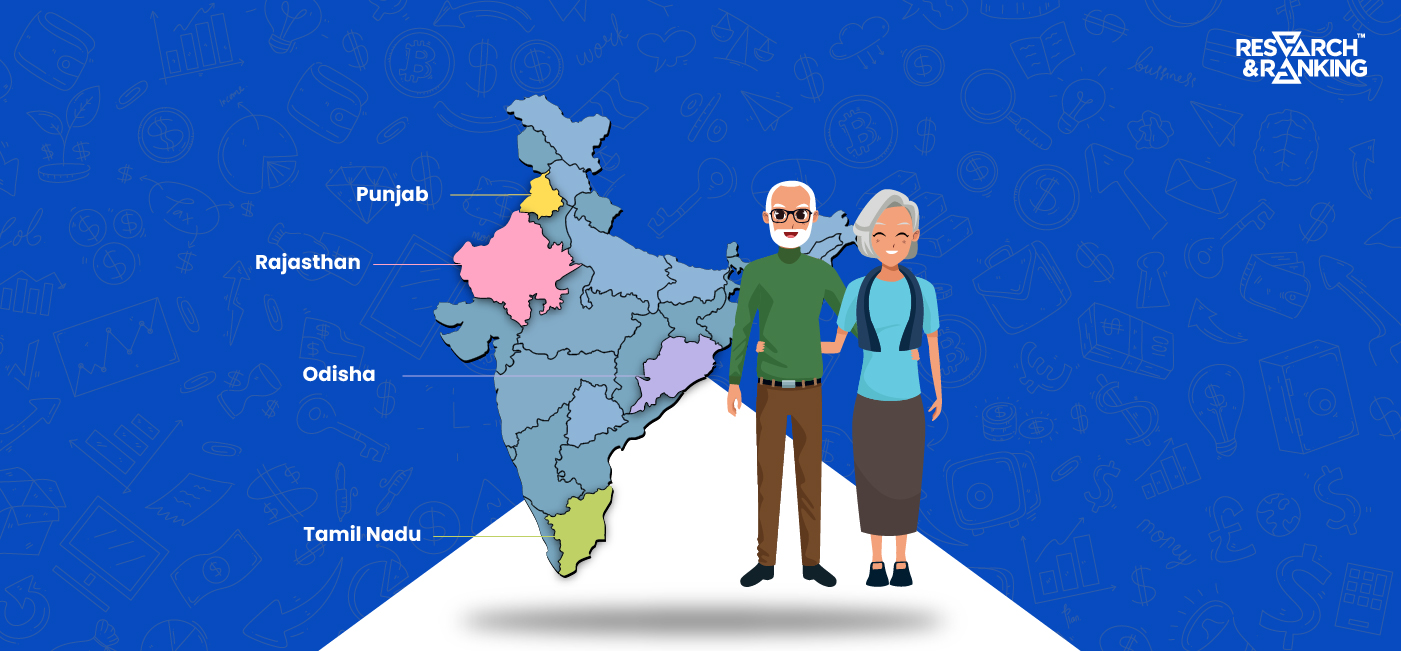

The Government of India has enacted various policies and initiatives to support the education, welfare, and empowerment of persons with disabilities, including children. You may want to avail the benefits that your child may be entitled to. Some of the schemes and programs you can explore are:

- Scholarship Scheme for Students with Disabilities: This is an umbrella scheme that covers pre-matric, post-matric, national overseas, national fellowship, free coaching, and top-class education for students with disabilities.

- Inclusive Education of the Disabled at Secondary Stage (IEDSS): This centrally sponsored scheme provides educational opportunities to children with disabilities in general schools. It covers students from class IX to XII and provides assistance for transport, books, uniforms, hostel, reader, escort, and other facilities.

- Assistance to Disabled Persons for Purchase / Fitting of Aids and Appliances (ADIP) Scheme: This initiative provides financial assistance to persons with disabilities for purchasing or fitting aids and appliances, such as hearing aids, wheelchairs, artificial limbs, etc.

These were just a handful of national policies. States across India have multiple special policies that you might want to explore.

Present and Future Care

Once you have assessed your child’s needs, you need to plan for how to meet them in the present and the future. This may involve:

- Create a budget and track the flow of your money, be it income or expenses.

- Building an emergency fund to cover unexpected costs or emergencies

- Saving and investing for your child’s education, health, and long-term care

- Protecting your family’s income and assets with insurance and estate planning

- Creating a support network of family, friends, and professionals who can help you and your child

Choose the Right Investment Options

Depending on your child’s needs and your financial goals, you may need to choose different investment options for different time horizons. Here are some examples of investment options that you can consider:

- For short-term goals (less than 5 years), you can consider low-risk and liquid options, such as savings accounts, fixed deposits, or liquid funds. These can help you access your money quickly and easily when you need it.

- For medium-term goals (5 to 10 years), you may want to invest in moderate-risk and moderate-return options, such as balanced funds, debt funds, or gold. These can help you grow your money reasonably while keeping some stability.

- For long-term goals (over 10 years), you may want to invest in high-risk and high-return options, such as equity funds, index funds, or stocks. These can help you generate higher returns over time and beat inflation.

It would also help to diversify your portfolio across different asset classes, sectors, and geographies to reduce risk and optimize your returns. If all this sounds overwhelming, getting help from a financial advisor would be highly beneficial as they are experts in planning and investing according to your specific needs.

Conclusion

Planning for the finances of your differently-abled child can be a complex and overwhelming task, but it is not impossible. With the right guidance, tools, and strategies, you can create a financial plan that can secure your child’s future and give you peace of mind.

To know more strategies to financially plan your child’s future, you can refer to our blog post on “How to Secure Your Child’s Future with Strategic Financial Planning”. Paired with the strategies discussed above, you’ll be able to draw a robust roadmap for your child’s future.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 1

No votes so far! Be the first to rate this post.