In the dynamic Indian financial landscape, JSW Infrastructure, a maritime services provider, made a significant entrance into the world of initial public offerings (IPOs). The anticipation was high, and investors were eager to know if they had secured a piece of the JSW Infra pie.

JSW IPO Listing Date

The wait will be finally over! JSW Infra’s shares were set to debut on the stock exchanges on October 3. Investors could soon see their investments come to life in the dynamic world of the stock market.

Here’s a quick snapshot of the JSW Infrastructure IPO:

| JSW Infrastructure IPO Details | |

| Total Issue Size | ₹2,800.00 crores |

| Face Value | ₹2 per share |

| Fresh Issue Size | 23.53 crore shares |

| Price Band | ₹113 to ₹119 per share |

| Lot Size | 126 Shares |

| IPO Open Date | Monday, September 25 |

| IPO Close Date | Wednesday, September 27 |

| Basis of Allotment | Thursday, September 28 |

| Initiation of Refunds | Wednesday, October 4 |

| Listing Date | Friday, October 6 |

So, we created a step-by-step guide below on how to check JSW IPO allotment status.

Three Ways to Check IPO Allotment Status

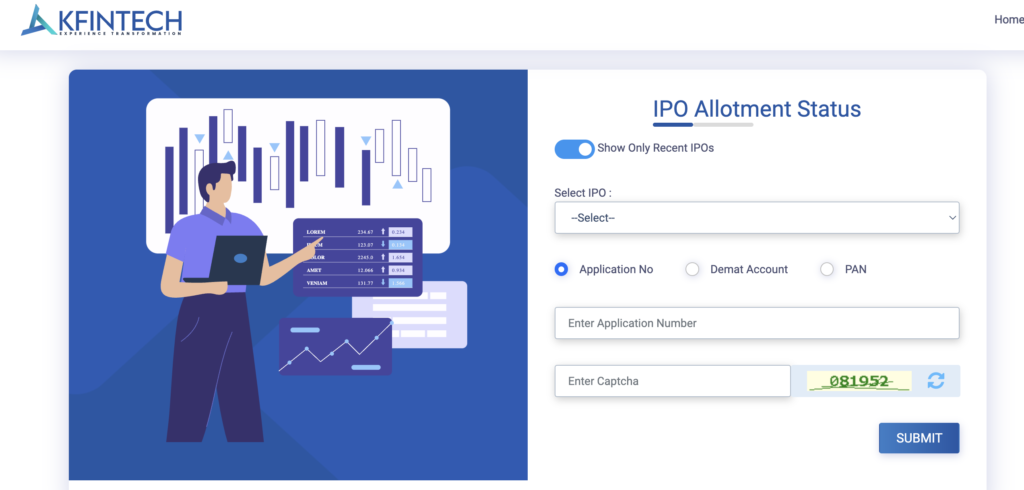

Option 1: Through The Website

- Go to the registrar’s website. Click here.

- Find five helpful links for checking status.

- Select JSW Infrastructure Limited in the Kfintech IPO allotment status

- Choose from three options: Application No, Demat Account, or PAN.

- For Application No, enter it along with the captcha code, then click “Submit.”

- For Demat Account, provide the captcha code and account details, then click “Submit.”

- To use PAN, enter the PAN number and captcha code, and click “Submit.”

The result? You can see your application status, including the number of shares applied for and the number allotted to you.

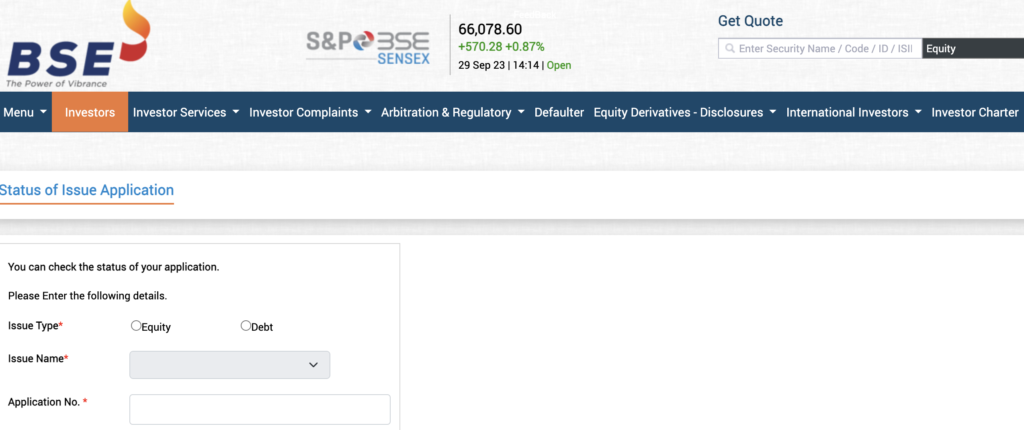

Option 2: Through Bombay Stock Exchange

- Go to BSE’s official website allotment page. Click here.

- Select ‘Equity’ under ‘Issue Type.’

- Pick the IPO from the drop-down menu under ‘Issue Name.’

- Input your PAN or application number.

Build your well-diversified portfolio

Create wealth now!

Build your well-diversified portfolio

Create wealth now!

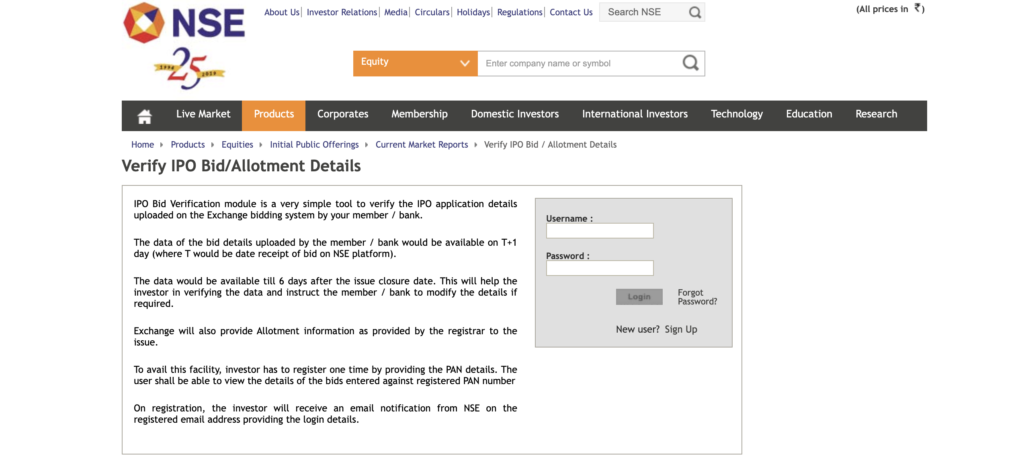

Option 3: Through the National Stock Exchange

- Go to NSE’s official website. Click here.

- Sign up by selecting the ‘Click here to sign up’ option and register with your PAN.

- Input your username, password, and captcha code.

- Visit the IPO allotment status on the subsequent page.

As the IPO journey unfolded, investors watched with bated breath. The IPO allotment status was a crucial piece of this financial puzzle. And now, armed with the knowledge of how to check their status, they eagerly awaited the listing date, ready to embark on their investment journey with JSW Infra.

How should I check my IPO allotment status?

You can check the IPO allotment status through the registrar’s or BSE and NSE websites. Read the blog for more details.

What information do I need to check my IPO allotment status?

Depending on your chosen method, you will need your Application Number, Demat Account details, or PAN (Permanent Account Number) to check your allotment status.

Can I check my JSW IPO allotment status without the application number?

Yes, you have multiple options to check your allotment status, and you can use your Demat Account details or PAN if you don’t have the application number readily available.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 3

No votes so far! Be the first to rate this post.