The Indian stock market is experiencing a frenzy as indices reach record highs. Private companies are taking advantage of the opportunity to list on the bourses, with an Initial Public Offering (IPO) launching almost every day, and most are receiving an overwhelming response from investors.

As of mid-August, at least 16 major companies have successfully launched their IPOs in 2023, raising over Rs—100 billion from the public. Moreover, approximately 42 companies are expected to tap into the equity markets in the coming months, aiming to generate around Rs. 540 billion.

This article could be helpful if you want to stay updated with the latest public offerings. Below is a list of the top five upcoming IPOs in September 2023. While some have already been announced, others are expected to receive final approval in the coming days.

Upcoming IPOs in September 2023

Here is a list of upcoming IPOs in September 2023:

Rishabh Instruments Limited

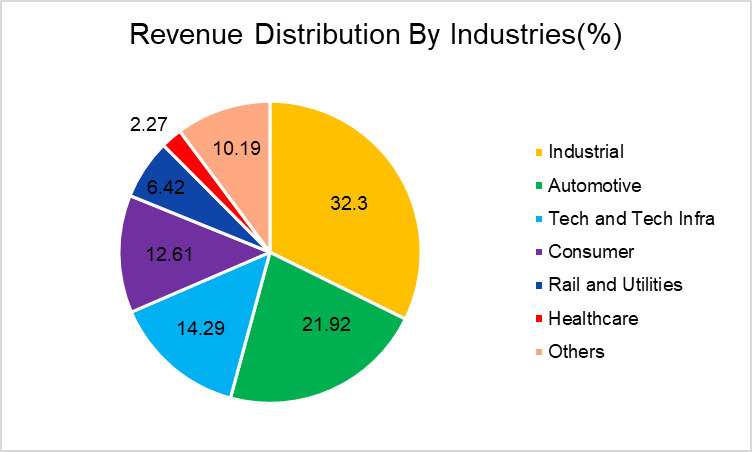

Rishabh Instruments Limited is a company based in India that specializes in providing energy efficiency solutions. They offer a wide range of products such as electrical automation, metering and measurement equipment, and precision-engineered products to clients across the power, automotive, and other sectors. The company also supplies its customers with various electrical measurement and process optimization equipment.

The IPO for Rishabh Instruments opened for public bidding from August 30, 2023, to September 1, 2023. The shares will be listed on the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) on September 11. Investors had the option to bid for multiple lots, with one lot having 34 shares in the price band of Rs. 418 to Rs. 441 per share.

Ratnaveer Precision Engineering Limited

Ratnaveer Precision Engineering Limited has recently announced its plans to launch an Initial Public Offering (IPO) in September 2023. The company manufactures high-quality stainless steel (SS) products, such as sheets, washers, roofing hooks, pipes, and tubes. In the Financial Year 2023, It recorded a net profit of Rs. 25.04 crore, a significant increase from its previous year’s earnings of Rs. 9.48 crore in FY 2022.

Ratnaveer Precision Engineering IPO opened for public subscription on 4 September 2023 and comprises a fresh issue of 1.38 crore equity shares and an offer for sale of up to 30.4 lakh equity shares. The issue closes on 6th September and will be listed on the exchanges on 14th September. The price band is Rs. 93-98, and each lot is 150 shares. Check the DRHP here.

Balaji Specialty Chemicals Limited

Balaji Specialty Chemicals Limited is a prominent Indian manufacturer that produces a range of specialized chemicals. Their product line comprises Ethylenediamine, Piperazine, Amino Ethyl Ethanol Amines, Diethylenetriamine, and Amino Ethy Piperazine. These chemicals are primarily used as solvents, corrosion control agents, and photographic chemicals in the pharmaceutical and agrochemical industries.

The Balaji Specialty Chemicals IPO is a book-built issue expected to hit the market in either the first or second week of September 2023. While the precise details of the IPO are not yet public, the company’s Draft Red Herring Prospectus outlines its plans to raise approximately Rs. 425 crores through the offering.

EbixCash Limited

EbixCash Limited is a modern technology provider that caters to both B2C and B2B segments through an integrated business model. Its services fall into four categories: Payment Solutions, Travel Solutions, Financial Technologies, and Business Processing Outsourcing (BPO). The company is one of India’s biggest technology service providers and has a well-established global presence.

The company intends to raise Rs. 6,000 crores through its Book Built issue, which is scheduled to enter the market in mid-September 2023. However, the company has yet to reveal other critical information, such as the price band, lot size, and listing date. You can check the DRHP here.

Tata Technologies

Investors eagerly anticipate the launch of Tata Technologies’ IPO, which would be the first IPO from the renowned Tata Group in nearly 20 years. Tata Technologies provides various services, including engineering and design, product lifecycle management, and IT service management.

After careful deliberation, Tata Technologies plans to launch its IPO in September 2023. The company’s unlisted shares are traded in the grey market at Rs. 800 to Rs. 900 per share. Check out the DRHP here.

Watch for more details on the upcoming IPOs in September 2023.

Read more: How Long-term investing helps create life-changing wealth – TOI.