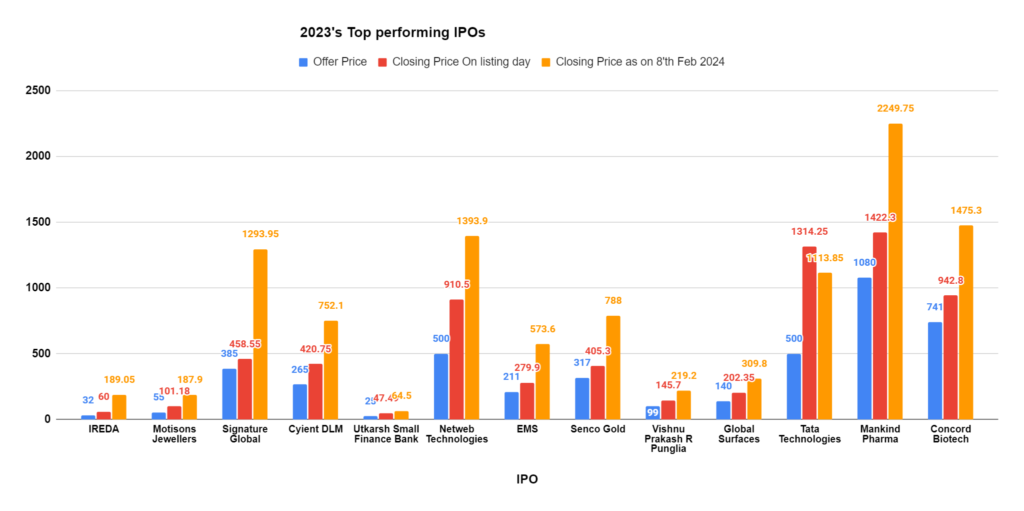

2023 was a golden year for the Indian stock market, especially for those who dared to dive into the exciting world of IPOs. Think of the frenzy, the anticipation, and the thrill of that first trading day! You might be sitting on a gold mine right now if you participated. But even if you weren’t part of the action, there’s still valuable wisdom to be learned from the market’s winners. The real breakout stars were on the mainboard, where, out of the 60 companies that went public, 13 saw their share prices soar. So, let’s take a look at their fabulous performance.

1. IREDA: The Undisputed Champion

Taking the lead position is IREDA, a renewable energy financing company. IREDA’s IPO opened at ₹138 and rocketed to a whopping ₹835 within a year, a gain of a mind-blowing 490%! That’s right if you had invested ₹1 lakh in IREDA at the IPO, you’d be sitting on a cool ₹6.35 lakh today.

2. Motisons Jewellers: Shining Bright

Jewelry might not be the first thing that comes to mind when you think of high-growth industries, but Motisons Jewellers proved otherwise. This Kolkata-based jeweler saw its share price zoom from ₹750 at IPO to ₹2,700, a stellar 260% return. So, if you were looking for some sparkle in your portfolio, Motisons definitely delivered!

3. Signature Global: Building a Fortune

Real estate developer Signature Global lived up to its name, growing its share price by an impressive 251% in 2023. The company’s IPO price was ₹145, and it reached a high of ₹508 within a year. This means that a ₹1 lakh investment at the IPO would have grown to a healthy ₹3.51 lakh. Not bad for a brick-and-mortar business!

4. Cyient DLM: Engineering Profits

Engineering and design company Cyient DLM made a strong debut, with its share price rising from ₹245 at IPO to ₹800, a commendable 228% gain. This translates to a potential ₹4 lakh return on a ₹1 lakh investment.

5. Utkarsh Small Finance Bank: Banking on Growth

Utkarsh Small Finance Bank (USFB) hit the ground running in March 2023, raising a cool ₹53.92 billion. But here’s the kicker: its share price zoomed 47% on the listing day itself! Rising from an offer price of ₹25 to its current ₹60, it has climbed a whopping 240% by February 2024. Talk about making an entrance!

6. Netweb Technologies: Weaving a Digital Net

Netweb Technologies, a leading IT infrastructure solutions provider, joined the party in April 2023, pulling in ₹541.15 crore. Their listing day saw a modest 11% jump, but that was just the beginning. By February 2024, the stock had skyrocketed a staggering 431%, from an offer price of ₹500 to its current ₹1394, making it one of the top gainers on the mainboard.

7. EMS: Delivering Value, Literally

Coming in hot in August 2023, Ecom Express Limited (EMS) raised ₹1,489 crore through its IPO. While the listing day saw a moderate 8% rise, things really took off in the following months. As of today, the stock has surged a remarkable 292%, standing tall at ₹574 from its original offer price of ₹211, leaving many investors pleasantly surprised.

8. Senco Gold

This jewelry manufacturer struck gold (pun intended!) with its IPO, opening at a 28% premium and closing its first day up a staggering 49%. This stellar performance wasn’t a flash in the pan, as the stock continued its upward trajectory, currently sitting 148% at ₹788, above its offer price of ₹317. Talk about a golden opportunity!

9. Vishnu Prakash R Punglia

The steel pipes and tubes manufacturer made a strong entrance, listing at a 38% premium and ending its debut day with a 53% gain. It hasn’t stopped there, currently boasting a 129% increase at ₹219 over its issue price of ₹99. Seems this IPO was anything but hollow!

10. Global Surfaces

A company dealing in decorative laminates and surfacing solutions made a stylish debut, opening at a 22% premium and closing its first day up 30%. The upward trend has continued, with the stock currently trading at ₹310 which is 71% above its offer price of ₹140. Looks like they’ve truly surfaced as a market leader!

11. Tata Technologies

This engineering services giant entered the scene with a bang, listing at a 14% premium and closing its first day up 18%. While its journey hasn’t been as meteoric as the others, it’s still a solid performer, currently trading at ₹1114, 29% above its offer price of ₹500. A testament to their technological strength!

12. Mankind Pharma

A pharmaceutical company, it proved that good health is good business, opening at a 53% premium and ending its first day with a phenomenal 67% gain. It hasn’t slowed down either, currently showing a 140% increase at ₹2249 over its offer price of ₹1080. This IPO was definitely a healthy dose of success!

13. Concord Biotech

This biopharmaceutical company specializing in oncology treatments entered the market with a 47% premium and closed its first day up a remarkable 64%. While it experienced some volatility, it’s currently trading at ₹ 1475, 44% above its offer price of ₹741. This company’s future looks bright, like the hope they provide to patients!

What made these superstars shine?

Well, the reasons are as varied as the companies themselves. Some, like IREDA, benefited from riding the wave of growing interest in renewable energy. Others, like Motisons Jewellers, capitalized on India’s strong demand for luxury goods. And still others, like Cyient DLM, offered investors exposure to hot sectors like technology and infrastructure.

So, what can we learn from these IPO champions? Well, it’s important to do your research before investing in any IPO. Don’t just get caught up in the hype; take the time to understand the company, its business model, and its risks. And remember, even the best IPOs can be volatile, so be prepared for some ups and downs along the way.