How does it feel when you manage to access an online government service smoothly? It’s fast, convenient, and saves time and energy, right? That’s BLS e-Services in a nutshell. They’re behind those smooth government e-services you use, like PAN card and Aadhaar enrolment.

But they’re not just friends of the government – banks and individuals trust them for all sorts of digital magic, too. So, let’s find out why, despite the Budget being the big news, the BLS e-Services IPO has everyone’s attention and if it could be the next big wave.

BLS e-services IPO Details

| Offer Price | ₹129 – ₹135 per share |

| Face Value | ₹10 per share |

| Opening Date | January 30, 2024 |

| Closing Date | February 1, 2024 |

| Total Issue Size (in Shares) | 2,41,30,000 |

| Total Issue Size (in ₹) | ₹310.91 Cr |

BLS e-services GMP

Gray market premium (GMP) soars to ₹155, indicating a potential listing price of ₹290 (+114.81% vs. IPO price). Analysts expect a strong debut based on the rising GMP trend (₹60 – ₹160) over the past week. Remember, the gray market is unregulated, so consider all the details before deciding.

Who Are They?

BLS e-Services isn’t just another tech startup. They’re a well-established player in the government e-services space, bridging the digital world and everyday needs. Think PAN cards, visas, and Aadhaar enrolment – these are just a few services they make accessible to millions across India.

Banks and individuals trust them for digital services, making their business mix diverse. Their network of over 18,000 touchpoints across 600 districts makes them a crucial link in the government’s digital vision.

What makes them tick?

BLS E-Services isn’t just about paper forms and ink stamps. They are constantly innovating and upgrading their services. They’ve invested heavily in artificial intelligence, cloud computing, and automation, ensuring smooth and efficient service delivery.

Financial Scorecard

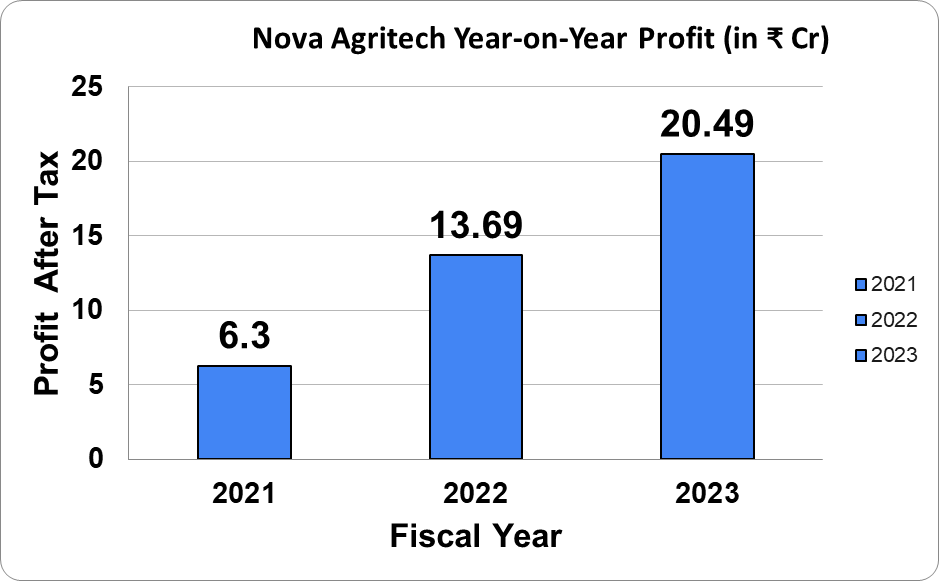

- Revenue: Rs 24,629.27 lakhs in FY23, showing steady growth.

- Profit (after Tax): Rs 2,033.18 lakhs, a healthy figure that indicates profitability.

- Return on Equity (ROE): 33.33%, a testament to their efficient use of resources.

SWOT analysis of BLS e-Services

| STRENGTHS | WEAKNESSES |

| The government’s digital push opens doors to expand and capture new markets. Can explore new international markets and service segments, diversifying their revenue streams further. Strategic acquisitions can be a smart way to expand their reach and offerings quickly. | A well-known name trusted by the government and individuals alike. Offers services across various sectors, reducing dependence on any single one. Invests heavily in technology, ensuring efficiency and smooth service delivery. An experienced team with deep industry knowledge guides the company. |

| OPPORTUNITIES | THREATS |

| The government’s digital push opens doors to expand and capture new markets. Can explore new international markets and service segments, diversifying their revenue streams further. Strategic acquisitions can be a smart way to expand their reach and offerings quickly. | If the economy stumbles, government spending might shrink. New technologies could disrupt the e-services space. Regulatory changes in operations can disrupt their business. |

What Does the Future Hold?

We rely on digital services for practically everything, and the government is focusing on online initiatives big-time. BLS e-Services could capitalize on this trend, expanding their reach and services. But, a thing to consider is that a significant portion of their revenue comes from government contracts, making them vulnerable to policy changes. And let’s not forget the ever-growing competition in the e-services space. New players are popping up from all directions, all vying for the same digital dollars.

Check out

The Verdict

BLS e-Services has a solid track record, a diverse business mix, and an apparent play on the booming digital landscape. But they also face the challenges of government dependence and fierce competition. Ultimately, the success of any investment depends on various factors, and BLS E-Services is no exception.

Do your research, understand the risks and rewards, consult an expert, and then make an informed decision based on your circumstances.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.