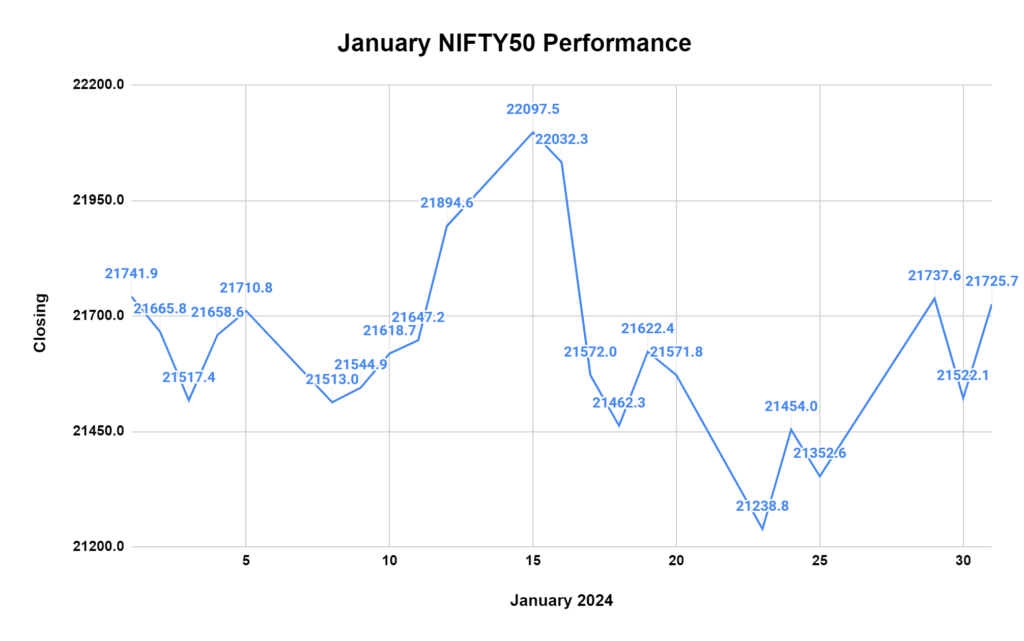

We entered 2024 with a rollercoaster ride, as January saw major ups and downs in the stock market. February’s now here with another potential blockbuster – the Apeejay Surendra Park Hotels Limited (ASPHL) IPO. This hospitality giant is known for its iconic “The Park” chain.

The Rs 920-crore IPO of Apeejay Surrendra Park Hotels was subscribed 45 percent on February 5, the first day of bidding. Retail investors bid 1.73 times, and high net-worth individuals (HNI) picked 51 percent of their allotted quota of shares. It has raised Rs 409.5 crore from anchor investors on February 2. Well-known investors such as Carnelian Capital, Julius Baer India, Citigroup Global, Integrated Core Strategies, Troo Capital, and Societe Generale picked shares in the company.

The offer is a mix of a fresh issue of shares worth Rs 600 crore and an offer of sale worth Rs 320 crore. The price band has been fixed at Rs 147-155 a share. The company’s promoters are Karan Paul, Priya Paul, Apeejay Surrendra Trust, and Great Eastern Stores.

So, what’s the buzz about? Let’s find out

Apeejay Surendra Park Hotels Limited Details

| Offer Price | ₹147 – ₹155 per share |

| Face Value | ₹1 per share |

| Opening Date | February 5, 2024 |

| Closing Date | February 7, 2024 |

| Total Issue Size (in ₹) | ₹920 Cr (Fresh issue: 600 cr and OFS: 320 cr) |

| Issue Type | Book Built |

Overview of Park Hotels

ASPHL has been in the hospitality game for over 50 years, building a reputation for high-end experiences under brands like The Park and Zone by The Park. Being India’s 8th largest hotel chain with asset ownership makes their credentials quite strong.

Top 6 Things To Know About Park Hotels IPO

The hospitality industry can be unpredictable. Remember the pandemic’s impact on travel and tourism? While their brand recognition and established presence are positive signs, there are factors to consider before you decide.

1. Size Matters: The issue size is a massive ₹920 cr! It means the company wants to raise serious capital, which could fuel expansion, upgrades, or even debt repayment. In other words, more money also means more responsibility, right?

2. Financial Scorecard: ASPHL witnessed a remarkable surge, with a staggering 95.81% spike in revenue and an impressive 270.42% rise in profit after tax (PAT) from the financial year ending on March 31, 2022, to March 31, 2023. Want to learn more? Check the DRHP here.

3. Brand Power: “The Park” isn’t just a name; it’s a symbol of luxury and experience. This brand recognition is a major strength, potentially attracting leisure and business travelers. But can they keep up the excellent work as they expand?

4. Industry Insights: The hospitality industry is quite unpredictable. Economic downturns hit them hard, and competition is fierce. So, while ASPHL has a solid track record, external factors could always play a role.

5. Debt Check: ASPHL has some debt on its books, like many companies. This isn’t necessarily a dealbreaker, but it could be something to remember. How will they manage their finances moving forward?

6. The GMP Factor: The Gray Market Premium (GMP) for ASPHL is currently available at ₹65. But remember, GMP is just an indicator, not a guarantee of success.

For a better understanding, let’s do a SWOT analysis of the ASPHL IPO

Know more about

IPO | Current IPO | Upcoming IPO | Listed IPO

| STRENGTHS | WEAKNESSES |

| Strong brand presence with a legacy of over 50 years Diversified portfolio across various segments (luxury, business, and budget) Experienced management team with a proven track record. Healthy financials with improving profitability | Dependence on online travel agents (OTAs) for bookings High debt levels. Relatively low liquidity ratios |

| OPPORTUNITIES | THREATS |

| Growing Indian hospitality sector Increasing disposable incomes Rising demand for leisure travel | Intense competition in the hospitality industry. Economic slowdown Regulatory changes |

The hospitality industry is a rollercoaster; even successful brands can face downturns. While Park Hotel’s financials may be impressive, their debt levels demand a cautious approach. The Grey Market Premium may be tempting, but it’s not guaranteed. Before deciding, research, weigh the risks and rewards, and align the investment with your overall strategy. Remember, the Park might be a beautiful destination, but choosing the right path is up to you.

Read More: Grey Market Premium

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.