Introduction

The Indian Pharmaceutical Industry is one of the world’s largest in terms of production by volume and value. It produces over 60,000 generic drugs in 60 different therapeutic categories. It meets 60% of the global vaccine demand, 40% of generic medicine demand in the US, 25% of all medicines in the UK, and exports drugs valued at over $24 billion globally.

This article will analyze India’s leading and most valuable pharmaceutical company Sun Pharma. The company had a humble beginning in 1983 and is now a world leader in generic and specialty medicines, with global sales of over $5 billion.

Let’s dig deeper into the company and see the Sun Pharma share price growth potential.

Sun Pharma Company Journey

Sun Pharma was established by Dilip Shanghvi in 1983 in Vapi, Gujarat, and initially focused on five products catering to psychiatric ailments. Before venturing into entrepreneurship, Dilip Shanghvi had gained experience as a helper in his father’s wholesale drug business based in Kolkata.

After completing his bachelor’s degree in commerce from the University of Calcutta in 1982, Shanghvi started his own company. With a small loan from his father, he aimed to produce high-quality medicines at affordable prices.

In 1988 Sun Pharma introduced its first cardiology products and expanded its offerings to include API manufacturing by 1995. Today, it stands as the fourth-largest specialty generic pharmaceutical company globally, with over $5.1 billion in revenue and over 40 state-of-the-art manufacturing facilities. Its reach extends to over 100 countries worldwide, providing essential medicines to a diverse population across the globe.

In the last 40 years, the company has acquired numerous companies worldwide, including Taro Pharma, URL Pharma, Pola Pharma in Japan, Biosintez in Russia, and Ranbaxy.

Sun Pharma Company Analysis

Sun Pharma’s marketed portfolio comprises innovative specialty medicines, branded generics, pure generics, and APIs. The company’s business is divided into seven different clusters:

- US Business

- India Business

- Emerging Market Business

- Global Specialty Business

- Rest of the World Business

- Global Consumer Healthcare Business

- API Business

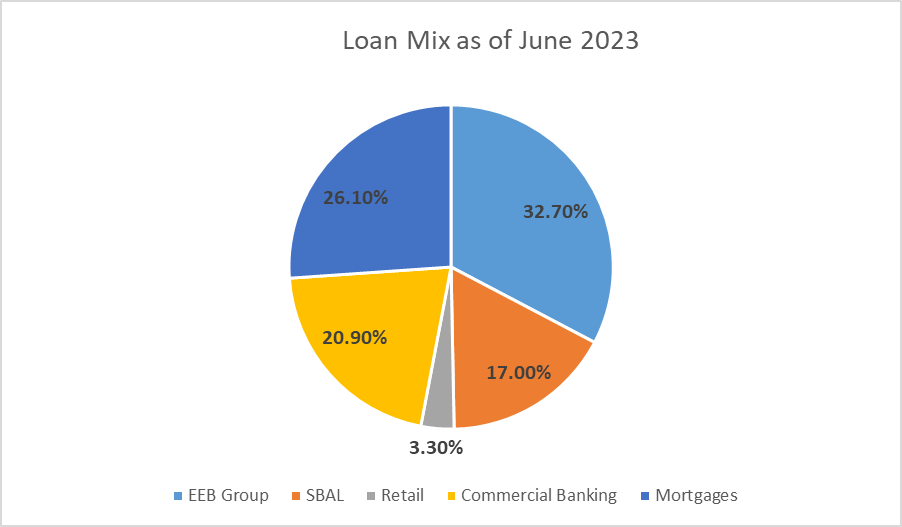

Sun Pharma’s US Business comprises sales of specialty and generic medicines. It is the 10th largest generics pharmaceutical company in the US and ranked 2nd by prescriptions in the US dermatology market. In FY23, the US business contributed 31% to the company’s consolidated revenues.

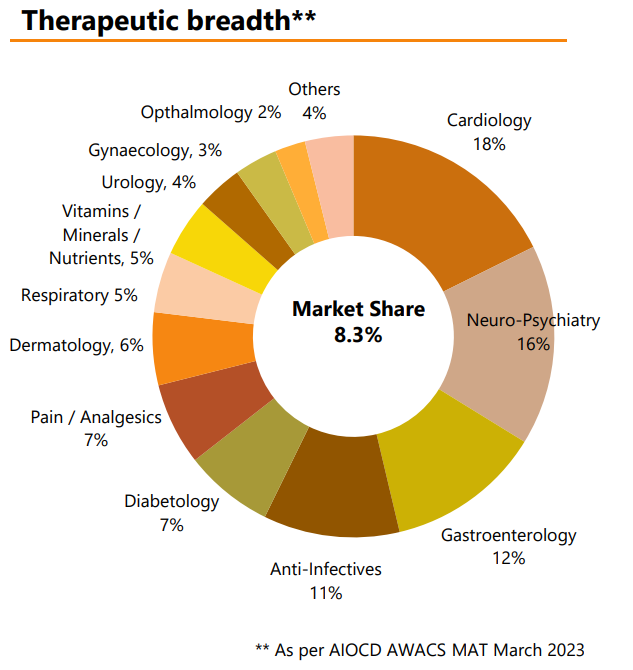

The company’s India Business contributes 32% to the consolidated revenue with an 8.3% market share. It offers a comprehensive product portfolio across various therapeutic and other segments.

Sun Pharma is one of the leading pharmaceutical companies in the Emerging Markets Business, with a presence in 80 countries. It accounted for 18% of the consolidated revenue for FY23.

The Rest of the World Business includes Western Europe, Canada, Israel, Japan, Australia, New Zealand, and other markets. It contributed 14% to the consolidated revenue in FY23.

Sun Pharma’s Global Consumer Healthcare Business is among India’s top five consumer healthcare companies, with a science-based portfolio and footprints in 25 emerging countries. Some iconic brands in the portfolio include Revital, Volini, and Abzorb.

Sun Pharma’s next emerging business is API Business, which caters to captive needs while supplying large generics manufacturers and innovator companies. It accounted for 5% of the consolidated revenue for FY23.

Operating Segments

Sun Pharma derives all its revenue from the sale of pharmaceutical products. Hence no different business segments are reported. Therefore, the group reportable segments are geography.

- India

- United States of America

- Emerging Markets

- Rest of the World

Key Management Personnel

- Dilip Shangvi is the Managing Director and leads the company’s operations.

- Abhay Gandhi is the CEO of North America and looks after the business operations in US and Canada. He joined Sun Pharma in 1995 as DGM- Marketing.

- Kirti Ganorkar is the CEO of India Business and joined the company in 1996.

- S. Damodharan is the CEO of API Business.

- Dr. Sapna Purohit is Senior Vice-President and Head of Human Resources and joined Sun Pharma in May 2018.

- And C.S. Muralidharan is the group’s chief financial officer and has been associated with the company since June 2017.

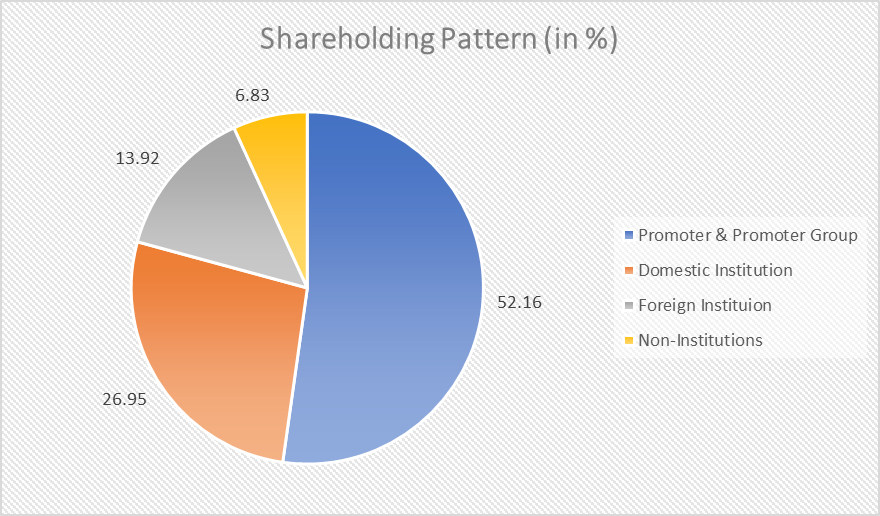

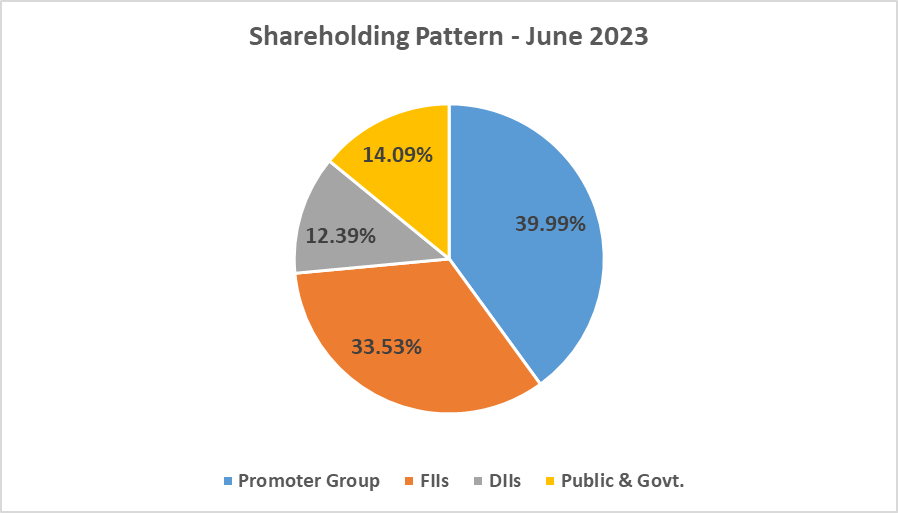

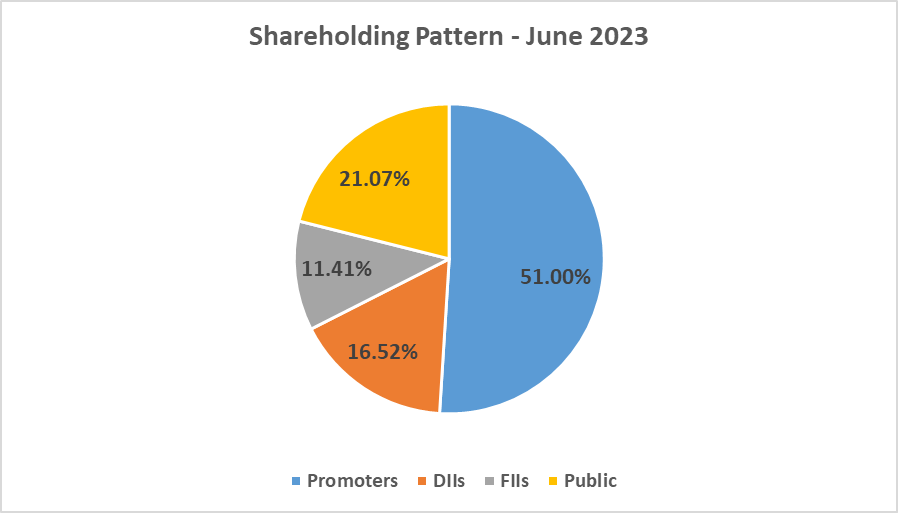

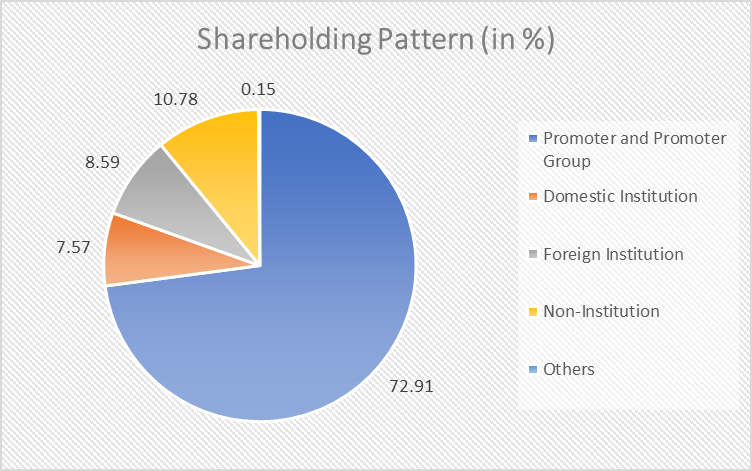

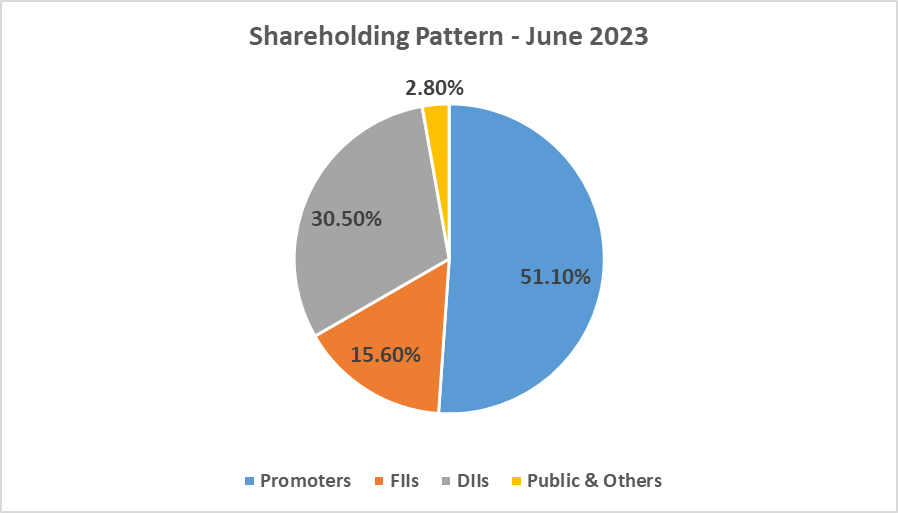

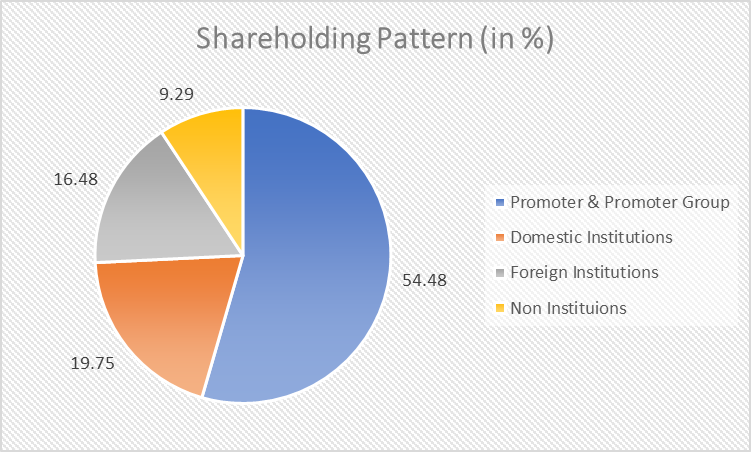

Sun Pharma Shareholding Pattern

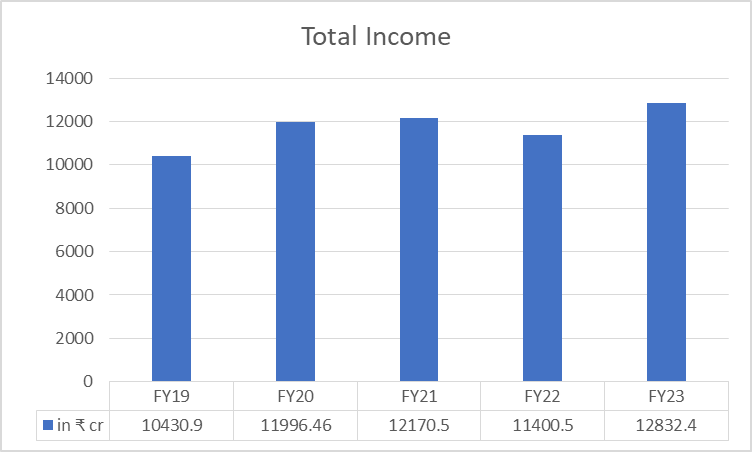

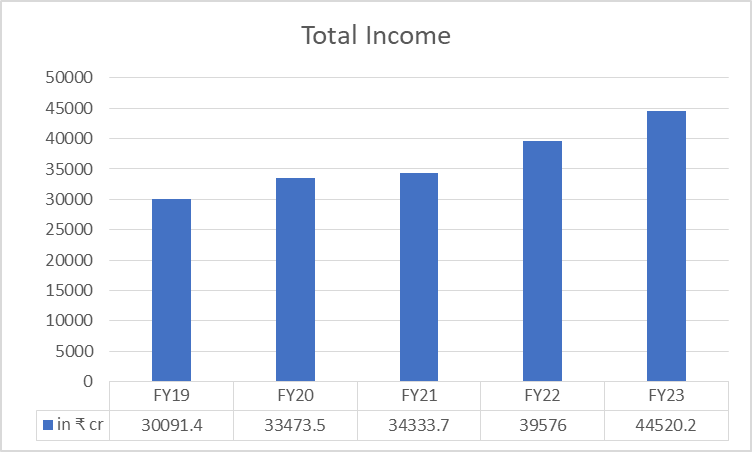

Sun Pharma Financials

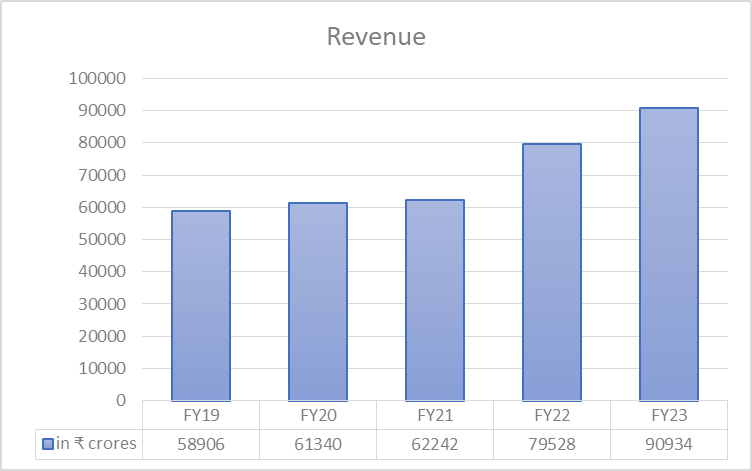

Revenue

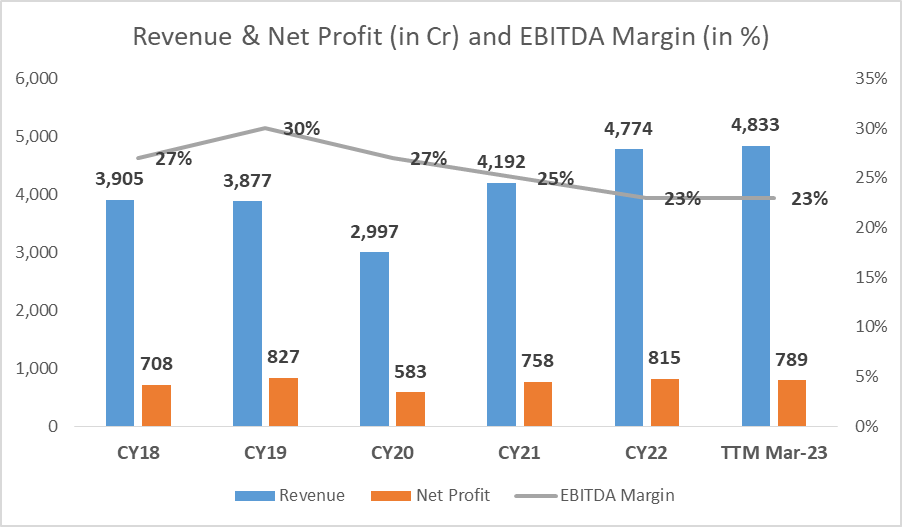

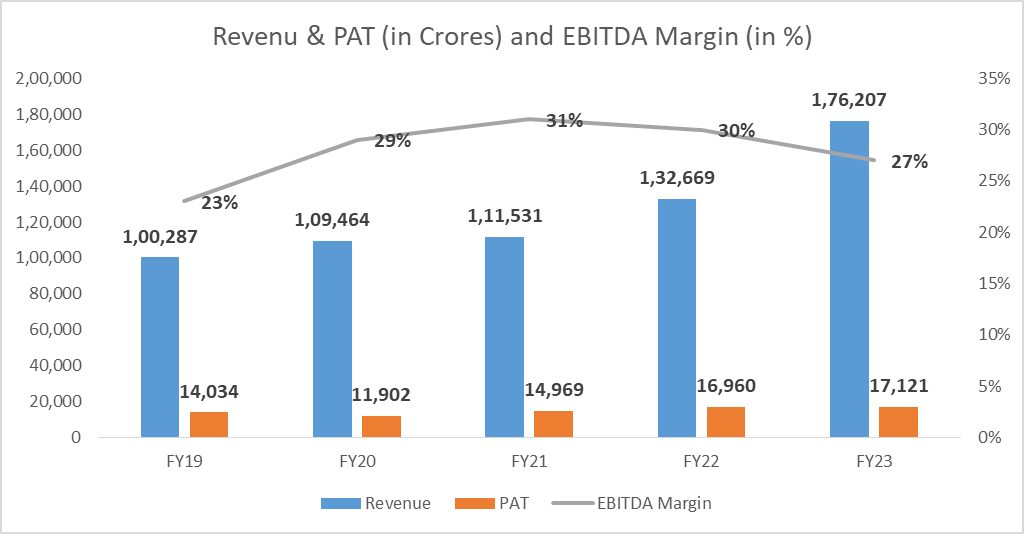

In FY23, Sun Pharma reported an 11.98% rise in total income to ₹44,520 crores, up from ₹39,756 crores in FY22. And, in Q1FY24, the total income was ₹12,145 crores, up by 12.8% compared to 10,763.9 crores in Q1FY23.

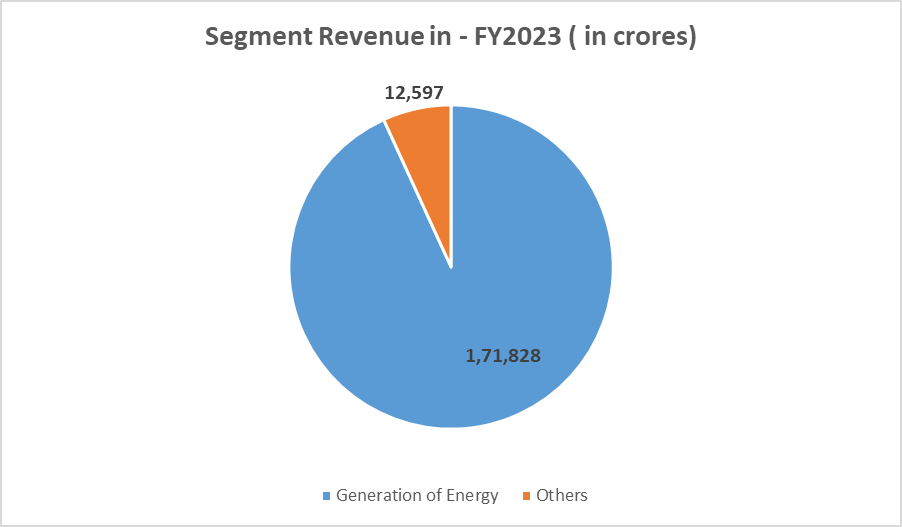

Segment-wise Revenue

| FY21 (in ₹ cr.) | FY22 (in ₹ cr.) | FY23 (in ₹ cr.) | |

| India | 10,958.3 | 13,443.8 | 14,162.4 |

| United States of America | 10,364.7 | 11,734.3 | 13,970.4 |

| Emerging Markets | 6,405.8 | 7,275.6 | 8,563.3 |

| Rest of the World | 5,504.1 | 5,972.5 | 6,582.7 |

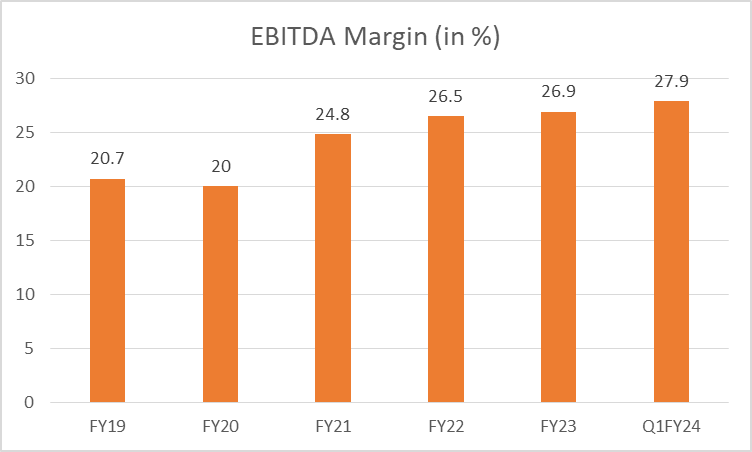

EBITDA

In FY23, the company’s EBITDA increased by 12% to ₹11,646 crores, from ₹10,169 crores in FY22. And, in Q1FY24, EBITDA was reported at ₹3,313.8 crores, up by 15.5% compared to Q1FY23.

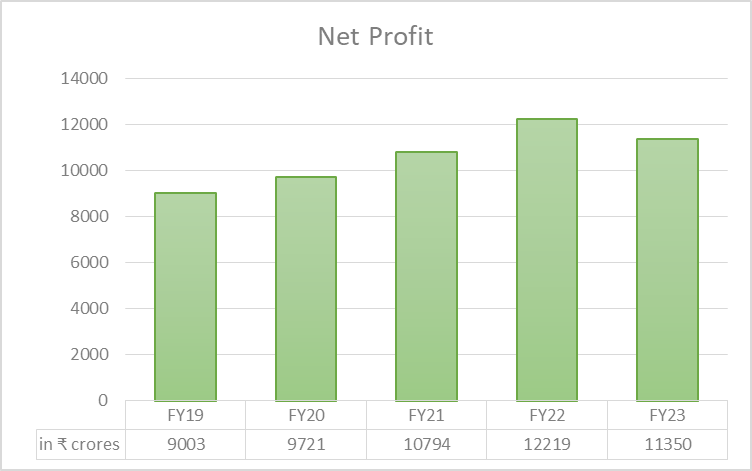

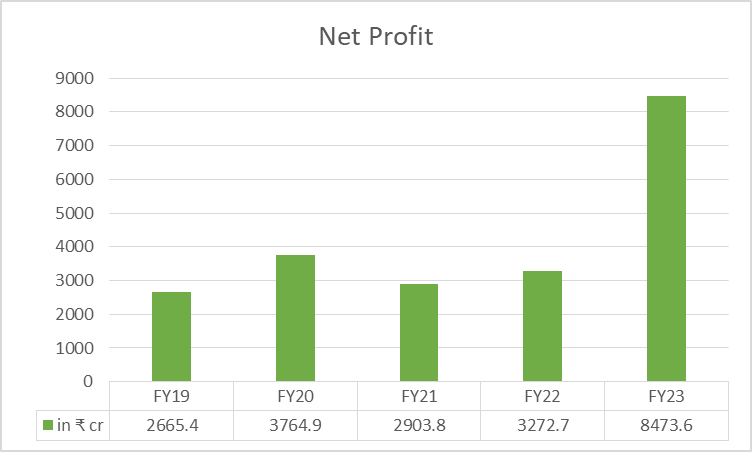

Net Profit

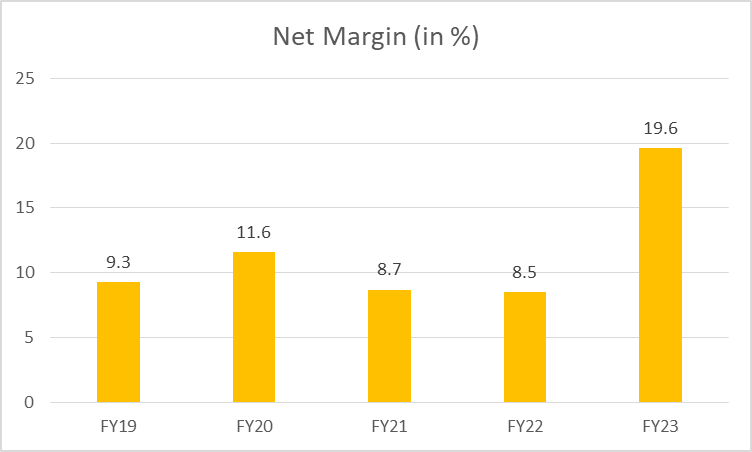

In FY23, Sun Pharma reported 159% year-on-year growth in net profit to ₹8,473.6 crores, from ₹3,272 crores in FY22. And, in Q1FY24, the company reported a 13.8% increase in net profit of ₹2,025 crores, over Q1 last year.

Financial Ratios

- Current Ratio: At the end of FY23, the company’s current ratio was stable at 2x.

- Debt-to-equity Ratio: Due to an increase in borrowing during FY23, the company’s debt-to-equity ratio increased by 300% to 0.12 times from 0.03 times in FY22.

- Interest Coverage Ratio: At the end of FY23, the interest coverage ratio deteriorated by 21.3% to 56.7 times from 72 in FY22.

- Return on Equity (ROE): The ROE for FY23 increased to 15.9% from 15% in FY22.

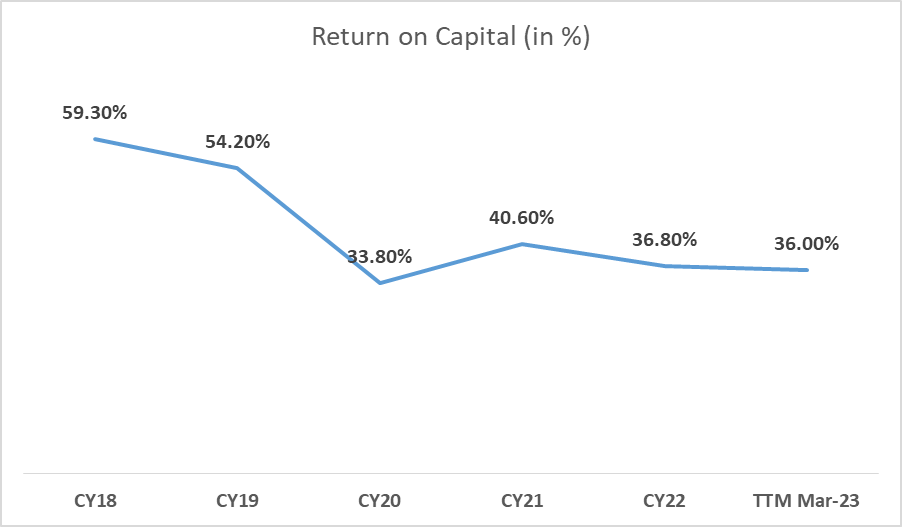

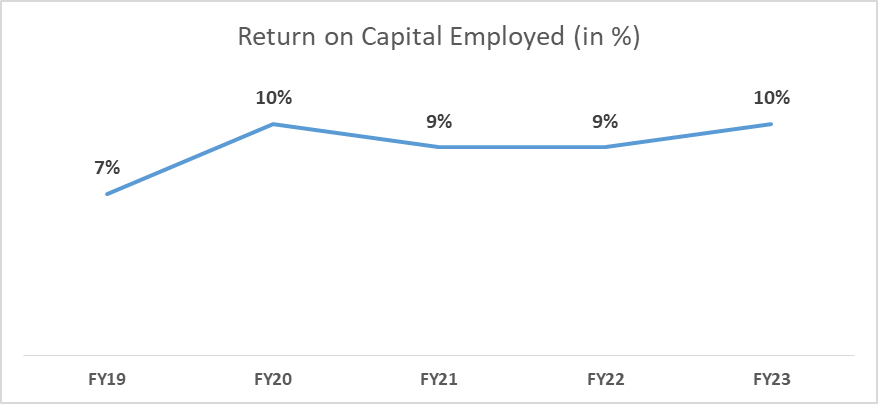

- Return on Capital Employed (ROCE): In FY23, the ROCE of the company increased marginally to 16.5% from 16.4% in FY22. In FY20, the ROCE was 11%.

- Reserves & Surplus: The company has a huge war chest of ₹55,755 crores at the end of FY23.

Sun Pharma Share Price Analysis

Sun Pharma’s initial public offering (IPO) took place in December 1994 and was a massive success in the market. The issue price was ₹150 per share, and it was 55 times oversubscribed. It went public at around ₹220 per share.

As on 7th August 2023, Sun Pharma share price has given a CAGR return of 30% and 15% over the last 3 and 5 years, respectively.

Sun Pharma share price has increased dramatically over the last five years, rising from ₹312 on March 30th, 2020, to ₹1166 on August 7th, 2023. It is trading near its all-time high level of ₹1200.80.

The company has a track record of consistently paying dividends to its shareholders. In the last three years, it has paid ₹7.5 in 2021, ₹10 in 2022, and ₹11.50 in 2023. Since it went public, the company had three bonus issues and split its shares twice. 100 shares held at IPO have turned 12,000 shares.

| Face Value | Ratio | Number of Shares | |

| Pre-bonus and split share | ₹10 | – | 100 |

| Bonus Issue- 9th Feb 2000 | ₹10 | 2:1 | 300 |

| Stock Split- 13th January 2003 | ₹5 | 10:5 | 600 |

| Bonus Issue- 21st April 2004 | ₹5 | 1:1 | 1200 |

| Stock Split- 24 January 2000 | ₹1 | 5:1 | 6000 |

| Bonus Issue- 28th May 2013 | ₹1 | 1:1 | 12000 |

As of 7th August 2023, the market capitalization of Sun Pharma is ₹2.78 lakh crores.

Sun Pharma Fundamental Analysis

Sun Pharma is a leading global specialty generic drug maker with a market share of 8.3% in India and a well-diversified product portfolio of both Indian-branded and US formulations.

The company’s strategy is to produce therapy drugs, used to treat and prevent diseases. This strategy has paid off handsomely. For the global market, it focuses on three areas of therapy: Dermatology, Ophthalmology, and Onco Dermatology. Over the last five years, the international specialty business has been one of the key growth drivers.

US Formulations

US formulation refers to pharmaceutical products developed, manufactured, and approved for sale in the United States. These formulations are specifically tailored to meet the regulatory requirements and standards set by the U.S. FDA.

In FY23, US Formulations accounted for 31% of the consolidated revenue and ranked 2nd by prescriptions in the US dermatology market. The company has a market presence in specialty, generics, and OTC segments with a comprehensive product portfolio. Over the last five years, US Formulations’s revenue has grown at a CAGR of 4.76%, from ₹10,700 crores in FY19 to ₹13,500 crores in FY23.

Indian Formulations

The company’s Indian Formulations business accounted for 32% of the consolidated revenue in FY23 and is ranked no.1 by prescriptions with 12 classes of prescribers. And is a market leader in the chronic segment.

Over the last five years, the revenue from Indian Formulations is growing at a steady rate. It has grown at a CAGR of 13.25% during the period, from ₹7,300 crores in FY19 to ₹13,600 crores in FY23.

Emerging Markets and the Rest of the World

In the emerging markets category, the company has a presence in over 80 countries and offers a strong basket of branded generics. It contributed 18% to the consolidated revenues in FY23.

While the rest of the world contributed 14% to the consolidated revenue, where the company offered a wide range of specialty, hospital, and retail products.

API Business

The company’s API business contributed 5% to the consolidated revenue in FY23 and has a product portfolio of approximately 370 APIs. It provides strong backward integration, helping reduce its dependency on third-party suppliers and supplying large generic drug manufacturers.

Sun Pharma Share Price Growth Potential

The company continues to grow ,rapidly, aided by strong sales in the specialty segment and improved product mix. The US and Indian market accounts for more than 60% of revenue and is on the path to further improvement with new product launches and expansion to new geographies.

However, heightened regulatory scrutiny, NLEM (National List of Essential Medicines) related price reductions in India, pricing environment, supply chain issues, and competition are a constant drag for the company.

Indian Pharmaceutical Industry

According to government data, the market size of the Indian Pharmaceutical Industry is around $50 billion as of 2020-2021 and is expected to reach $130 billion by 2030. And the Indian generics market is one of the fastest-growing and most lucrative segments of the global pharmaceutical industry, driven by factors like cost competitiveness, high-quality standards, increasing demand, and favorable government policies.

It presents substantial growth opportunities for companies like Sun Pharma, which has a strong balance sheet and reserves on its book to help expand its business lines. And it is likely to have a positive impact on the price of Sun Pharma share price over the long term.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

Who founded Sun Pharma?

Sun Pharma was founded by Dilip Shangvi in 1983 in Vapi, Gujarat, and initially started with five products catering to psychiatric ailments. Before founding Sun Pharma, Dilip Shangvi was assisting his father in this wholesale drug business in Kolkata as a helper.

How has Sun Pharma share price performed in the last five years?

As of 7th August 2023, Sun Pharma share price has given a CAGR return of 30% in the last five years, rising from ₹312 on March 30th, 2020, to ₹1166 on August 7th, 2023.

How has Sun Pharma share price performed since its IPO?

Sun Pharmaceutical went public in 1994. Its IPO was priced at ₹150 per share and listed on the ₹220. The stock was split twice, and the company issued bonus shares three times. 100 shares purchased at the IPO has grown to 1200 shares.

Read more: How Long-term investing helps create life-changing wealth – TOI.