Have you ever noticed how everyday items have become more comfortable in recent years, with ergonomic designs that feel right in your hand? Or the increasing reliability of our communication networks and healthcare systems?

The combination of design and technology has helped companies create innovative products that are easy to use and positively impact people’s lives. And companies like Tata Elxsi play a considerable role. The world’s leading provider of design and technology services across industries.

In this article, we will do a company analysis of Tata Elxsi Ltd. and check out its share price history.

Overview of Tata Elxsi Ltd.

Tata Elxsi commenced its business on 5 May 1989 in Bangalore and is mainly involved in developing and promoting electronics, embedded systems, and software applications. Over the years, it has evolved its business structure and offering and is recognized as a premium engineering service provider globally.

The company operates across various industries and offers a diverse set of services, such as:

Product Design and Engineering: The company helps its clients develop innovative and aesthetically designed products across industries such as automotive, healthcare, consumer electronics, railways, and more. It offers mechanical design, 3D modeling, simulation, and prototyping to develop physical products and components.

Embedded Systems and Software: Tata Elxsi specializes in developing embedded software and firmware for different applications. Embedded software and firmware is a type of software that controls hardware devices but not computers. For example, remote controls, in-vehicle computers, digital cameras, IoT devices, etc. It offers software for testing and quality assurance services for checking the performance and reliability of software and embedded systems.

Automotive and Transportation Solutions: It assists companies in product design and development, including interior, connected systems, infotainment systems, etc., and advanced systems related to autonomous vehicles, electric mobility, etc.

Broadcast and Communication: In the broadcasting and media industry, it offers services, including content creation, digital transformation, and streaming solutions.

Similarly, in the communications segment, it provides services like infrastructure design, network management, signal processing, and wireless protocol solutions for telecom operators.

Healthcare and Life Sciences: It offers design and development of medical devices, healthcare software, telemedicine solutions, healthcare IT services like electronic health record (EHR) implementation, data analytics, etc.

Tata Elxsi also leverages Artificial Intelligence (AI) and Machine Learning (ML) to develop solutions for various industries, such as predictive maintenance, data analytics, voice and speech recognition, etc. It also offers services to the Aerospace and Defense industry, semiconductors, etc.

Tata Elxsi Business Overview

As defined in the Accounting Standard 108- operating segments, the company has identified two business segments:

- Software Development & Services

- System Integration & Support Services

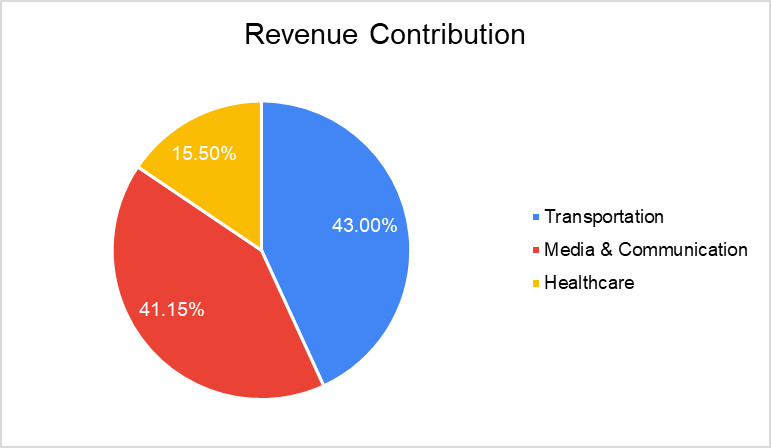

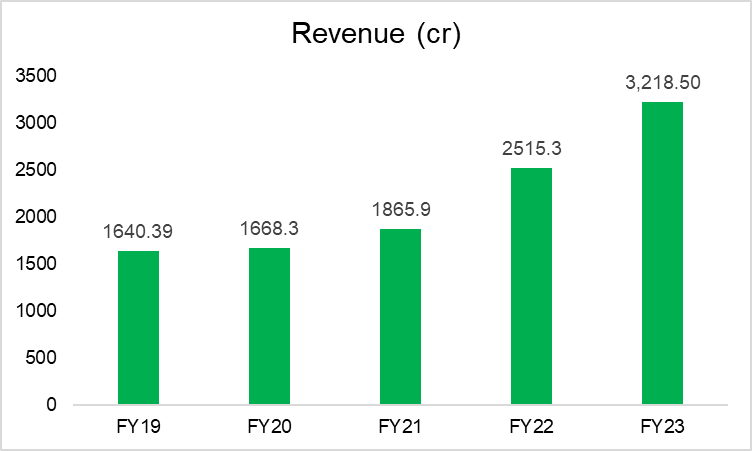

In FY23, Tata Elxsi reported a total revenue of ₹3,218.5 crores and has earned a significant share of the revenue from the transportation vertical, followed by media & communication and healthcare.

Tata Elxsi Management Team

Tata Elxsi has a workforce of over 12,000 people spread across 16 countries. The company is led by:

- Mr. Manoj Raghavan, who is the Managing Director & CEO. He has been with the company since 1997 and began his career with the Tata Group in 1993 as a Graduate Trainee Engineer at Tata Motors.

- Mr. Nitin Pai is the CMO and Chief Strategy Officer. He joined Tata Elxsi in 1996 as a product manager and has held various leadership roles in the marketing and design division. Mr. Pai is a Mechanical Engineer from BITS Pilani.

- Mr. Gaurav Bajaj is the Chief Financial Officer at Tata Elxsi. He joined Tata Elxsi in January 2021, previously working for Wipro Ltd. Mr. Gaurav is an ICAI-certified chartered accountant.

- Mr. Philip Mammen is the Vice President- Human Resources and has been with the company since January 2007.

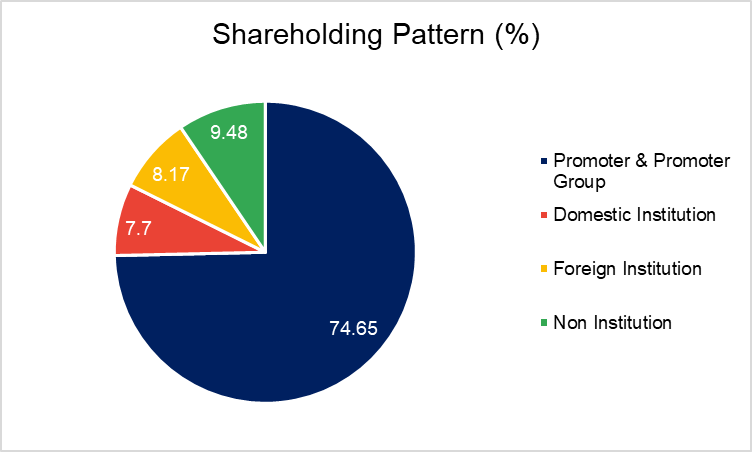

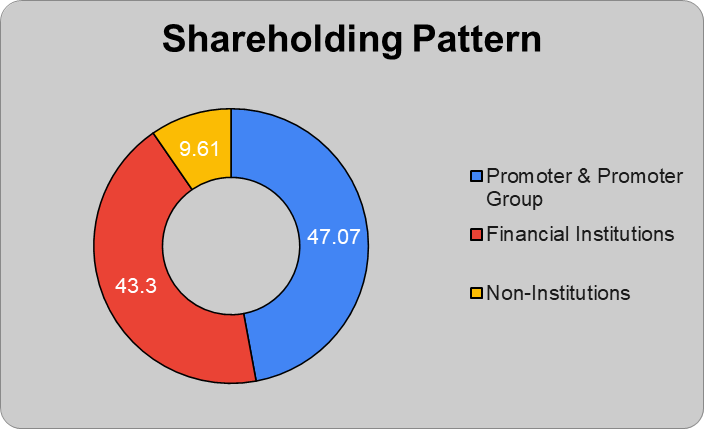

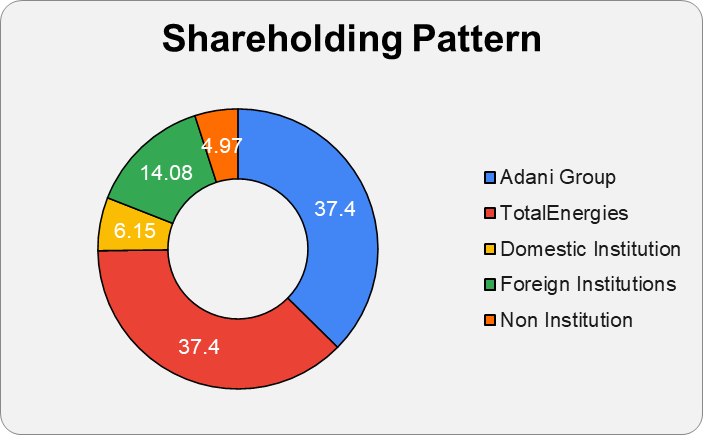

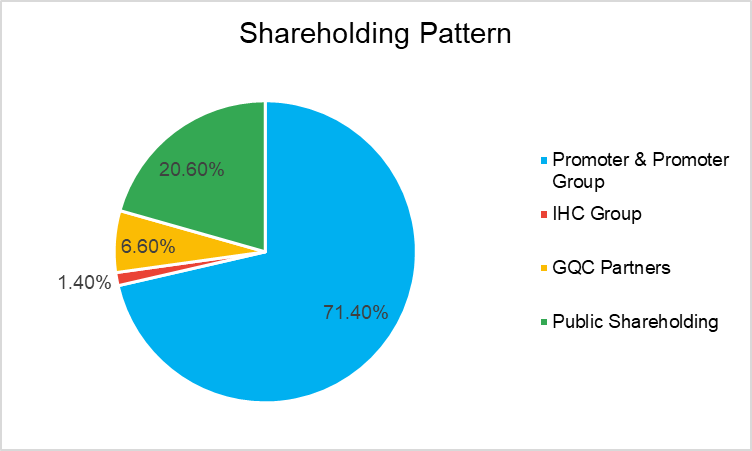

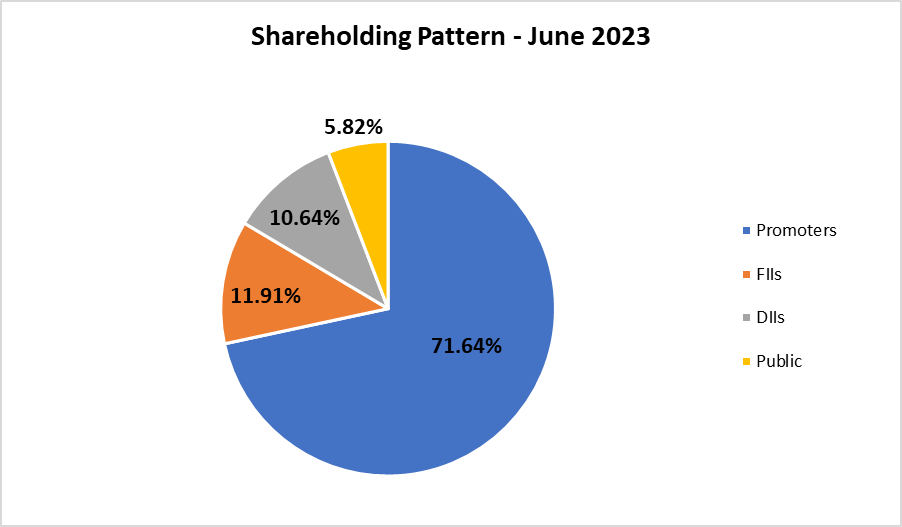

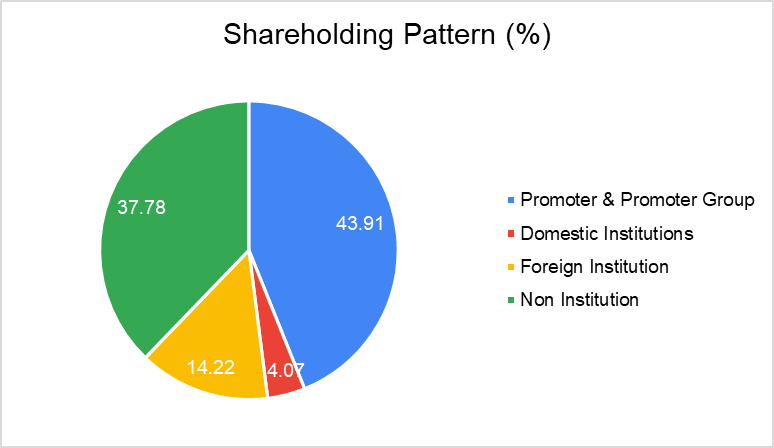

Shareholding Pattern

Tata Elxsi Financial Review

Revenue

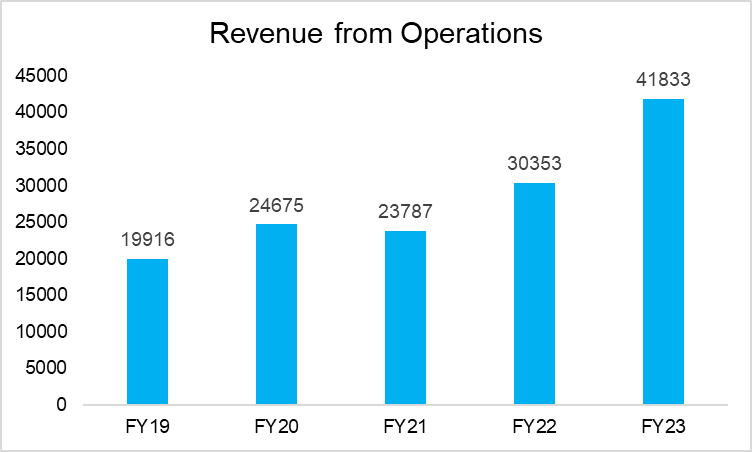

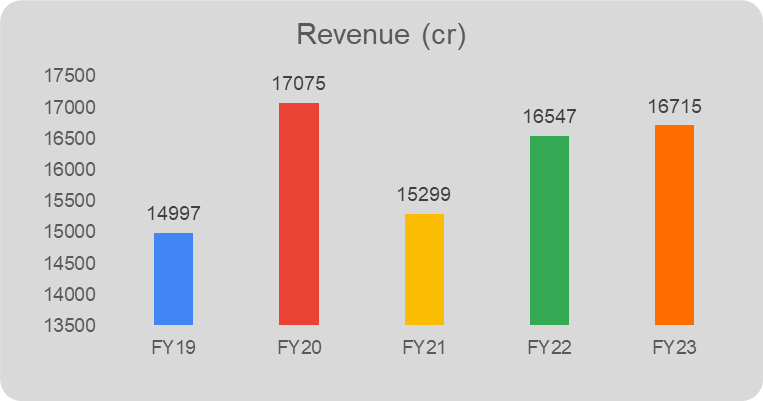

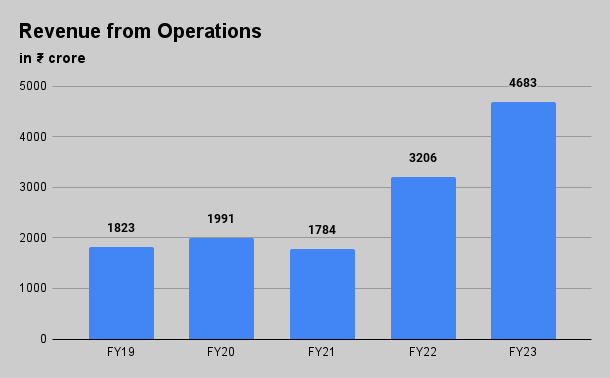

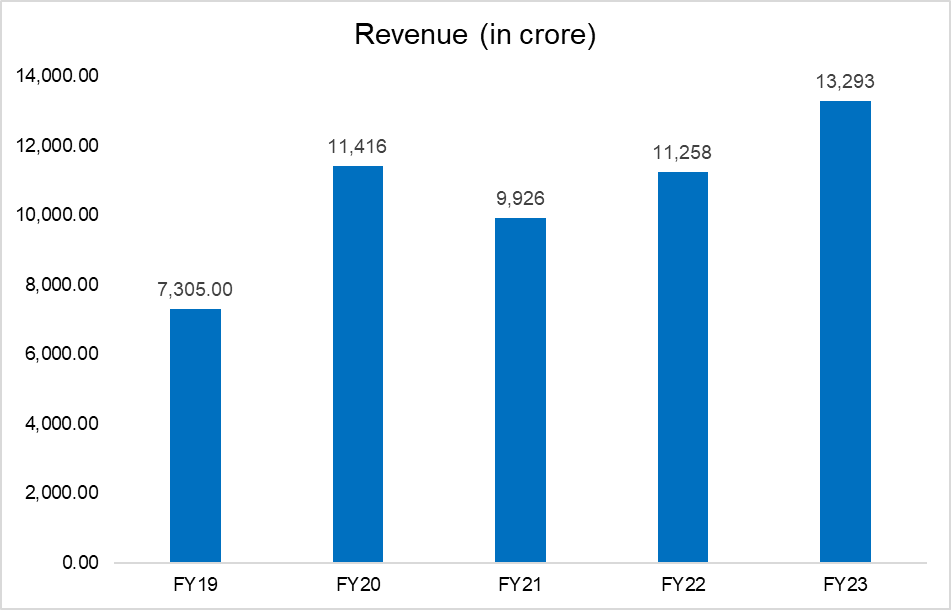

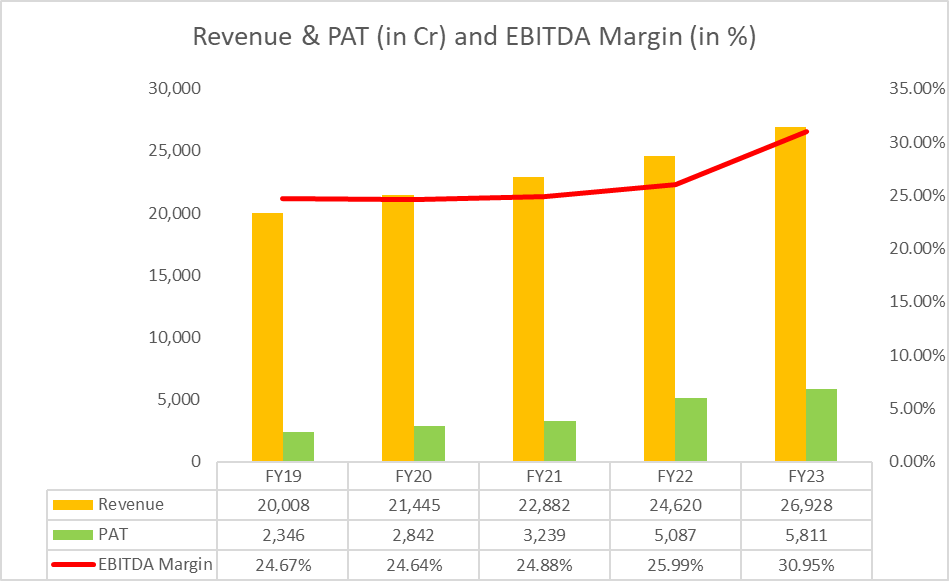

In FY23, Tata Elxsi reported a 27.9% year-on-year rise in revenue to ₹3,218.5 crores from 2,515.3 crores in FY22. And, in Q1FY24, total income rose by 18.5% to ₹872.5 crores, from ₹736.2 crores in Q1FY23.

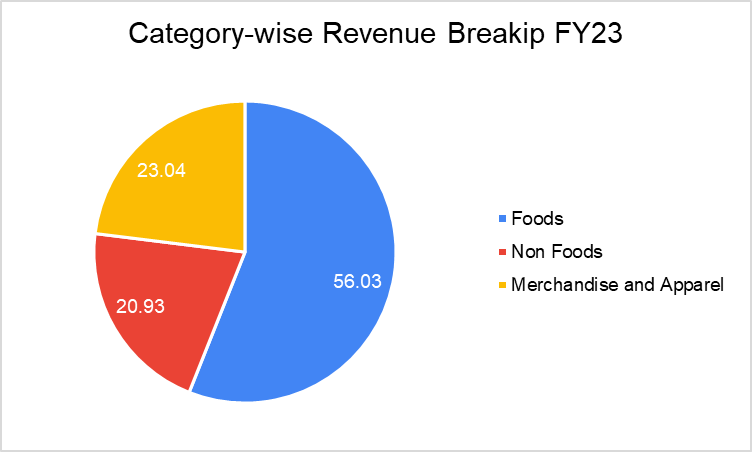

Segment-wise Revenue Breakup

| FY22 (in ₹ cr) | FY23 (in ₹ cr) | Q1FY23 (in ₹ cr) | Q1FY24 (in ₹ cr) | |

| Software Development & Services | 2421.31 | 3,065.94 | 710.85 | 827.46 |

| System Integration & Support Services | 494.8 | 787.75 | 15.03 | 22.80 |

Geographic-wise Revenue Breakup

| FY22 (in ₹ cr) | FY23 (in ₹ cr) | Growth | |

| India | 393.07 | 521.54 | 32.68% |

| US | 1041.63 | 1322.72 | 26.99% |

| Europe | 755.77 | 1139.50 | 50.77% |

| Others | 280.31 | 160.94 | -42.58% |

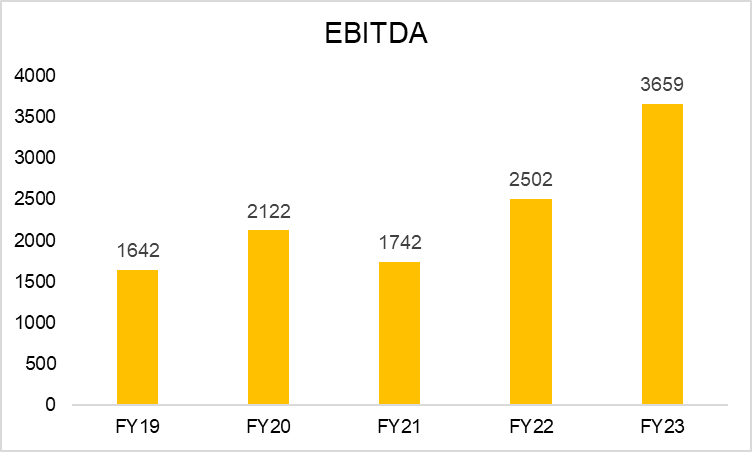

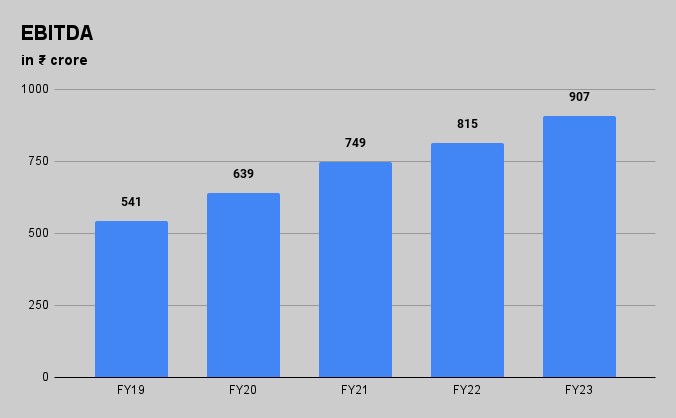

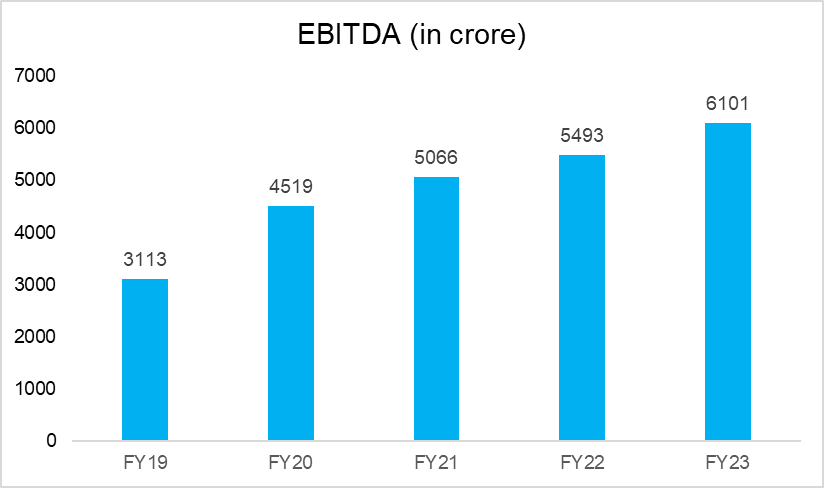

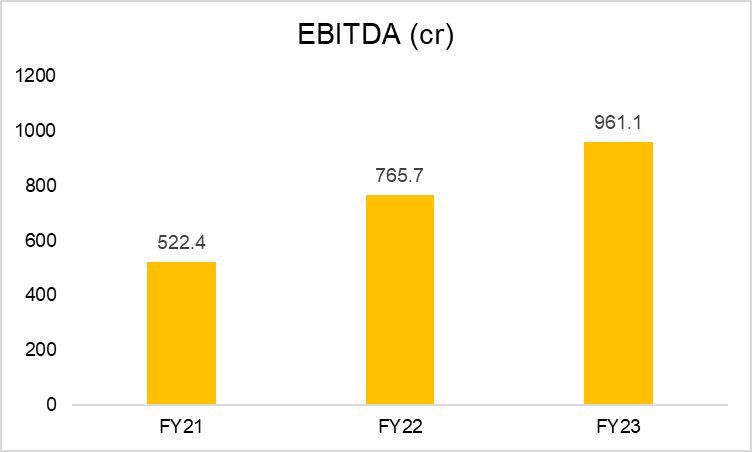

EBITDA

In FY23, the company reported an EBITDA of ₹961.1 crores, an increase of 25.5% year-over-year, compared to ₹765.7 crores in FY22. The EBITDA margin in FY23 was 30.6%, compared to 31% in FY22. In Q1FY24, EBITDA witnessed a year-on-year growth of 5.6% to ₹251.5 crores from ₹238.2 crores.

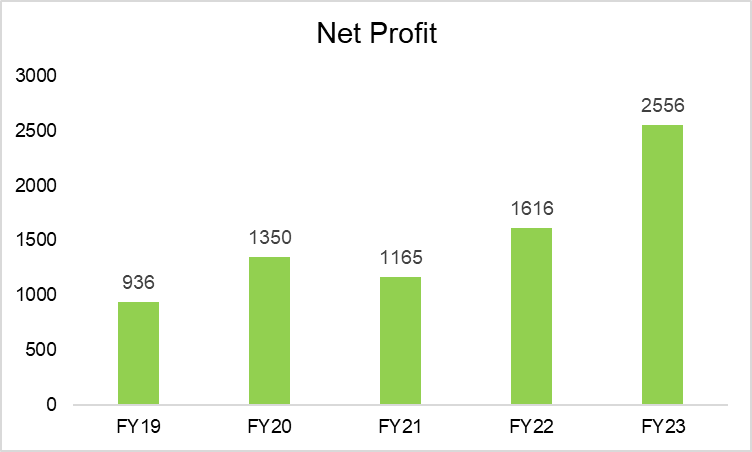

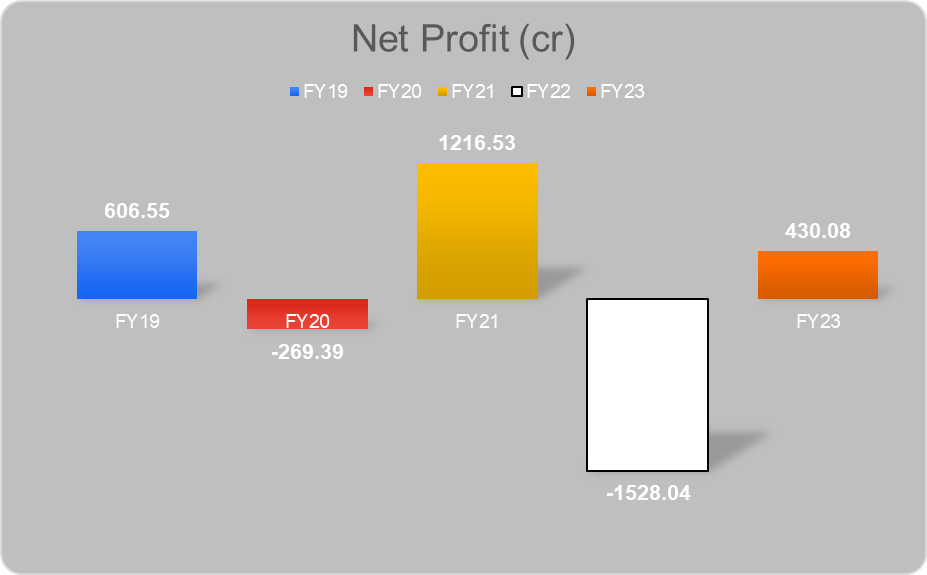

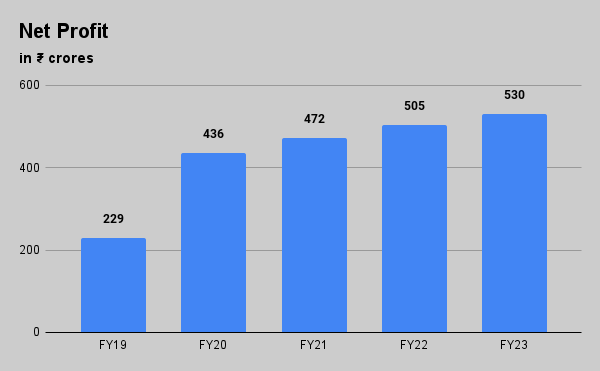

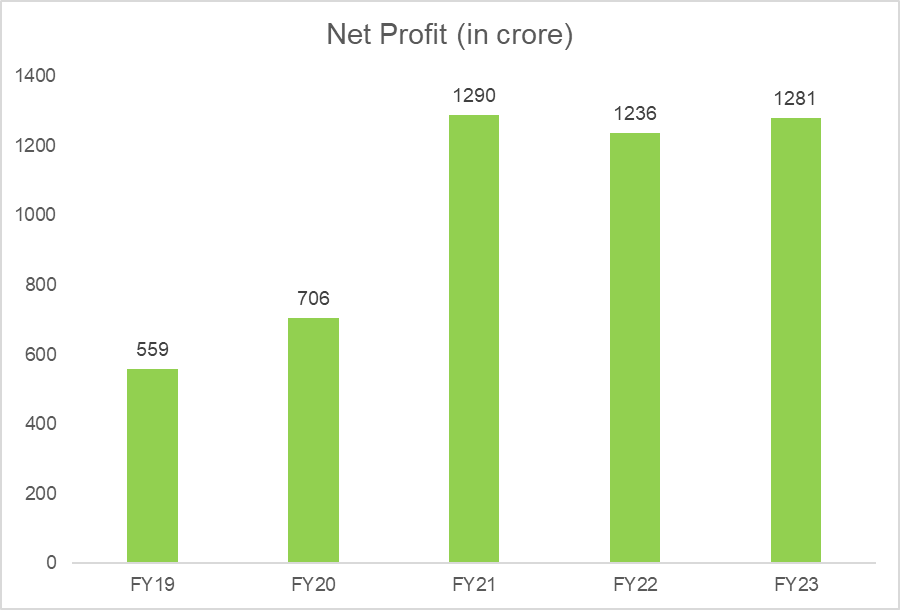

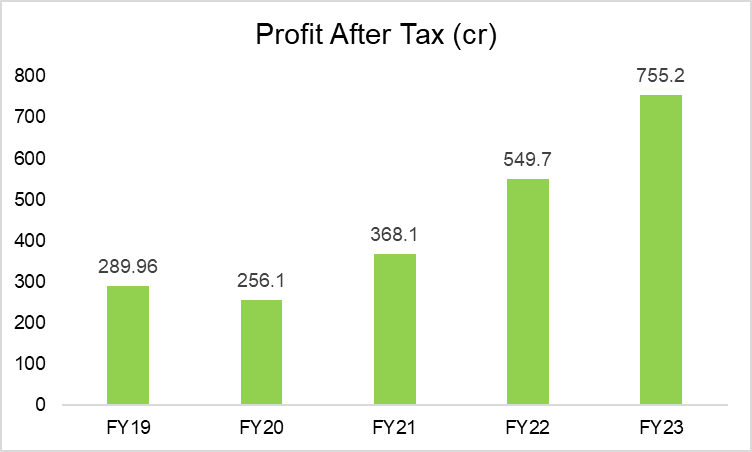

Profit After Tax

In FY23, Tata Elxsi Ltd. reported a 37.4% year-on-year rise in net profit to ₹755.2 crores from ₹549.7 crores. In Q1FY24, the company reported a 2.2% increase in net profit to ₹188.9 crores from ₹184.7 crores.

Tata Elxsi Key Financial Ratios

Current Ratio: At the end of FY23, the current ratio stood at 4.83 times, compared to 4.13 times at the end of FY22.

Debt-to-equity Ratio: The company has no long-term debt, and the debt-to-equity ratio is stable at 0.09 times at the end of FY23.

Net Profit Margin: In FY23, the net profit margin increased to 24.01% from 22.25% in FY22.

Return on Equity (ROE): The ROE of the company at the end of FY23 was 40.97%, compared to 37.23% at the end of FY22.

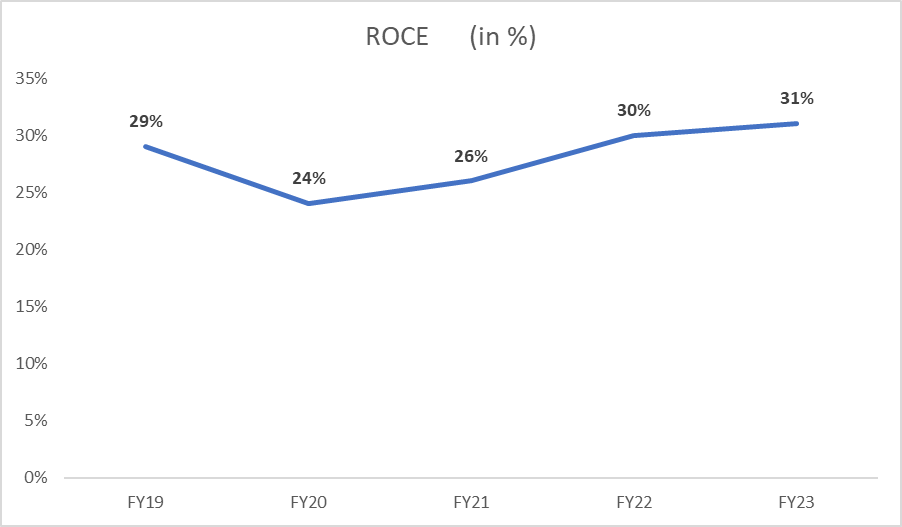

Return on Capital Employed (ROCE): The ROCE of the company declined slightly to 42.05% at the end of FY23, compared to 43.4% at the end of FY22.

Tata Elxsi Share Price History

Tata Elxsi has given a stellar return to investors, becoming a tremendous success. It launched its IPO in 1995, and from September 1995, the stock has surged from ₹13.5 to reach an all-time high of ₹10,760 in August 2021.

If an investor had invested ₹1 lakh in this stock in September 1995 and remained invested during this period, the value of the stock would have turned more than ₹13 crores today.

The company issued bonus shares in the ratio of 1:1 on 18th September 2017 and has a consistent track record of paying dividends to shareholders. It paid ₹24 in 2021, ₹42.50 in 2022, and ₹60.60 in 2023 as dividends.

As of 27 September, Tata Elxsi share price has given a CAGR return of 45% and 79% in the last five and three years, respectively. The market cap of the company at this date is ₹45,466 crores.

Tata Elxsi Ltd. Company Analysis

Tata Elxsi has experienced remarkable growth since its establishment, continuously evolving to adapt to changing times and shifting customer preferences. Its growth journey over the years is divided into four stages:

Gen 1 was between FY94 and FY03, wherein the company focused on developing system integration services (SI) and Engineering, Research & Development (ER&D).

Gen 2 growth stage lasted from FY04 to FY13; the company launched the Industrial Design business and Visual Computing Labs for visualization and animation.

In the Gen 3 growth stage, which lasted from FY14 to FY19, the company merged the VLC division with Industrial Design, entered the medical electronics business, and achieved leadership in Auto, Media, and Communication.

Gen 4: In its ongoing growth stage from FY20, the company is now focusing on Design-led Engineering for scaling growth. During this period, the CAGR growth in revenue has been 24.5%.

Financial Performance Review

Tata Elxsi is majorly earning from three verticals- Transportation, Healthcare, and Media & Communications.

Transportation

During FY23, The company’s transportation business grew by 32.7% and contributed ₹1,177 crores to the revenue, aided by large deals and growth across segments like EV, software-defined vehicles, and connected cars. The company is a leading provider of transformative technologies for connected, autonomous, and electric cars, with solutions like the AUTONOMIA platform for driverless cars and Tata Elxsi’s e-Cockpit. Besides, it has a vast suite of EV solutions, electric motor solutions, and battery management systems.

Media & Communications

The media & communications division posted 18.5% year-on-year growth, generating ₹1,132.2 crores in revenue. In media, the company has benefitted from the shift towards digital streaming and services. Its award-winning solutions help streaming platforms and media companies stay on top of the game, including content curation. The growing availability of 5G networks has also created an enormous opportunity and has won strategic deals from leading operators from EMEA and a leading multi-system operator in North America.

Healthcare

In FY23, the healthcare division posted strong year-on-year growth of 37.6%, contributing ₹423.5 crore to the top line. The company is offering services in the areas of digital and connected healthcare. And solutions like TEngage and TEDREG help pharmaceutical companies to monitor and capture real-time updates to global healthcare standards.

Key Highlights from Earning Calls

- Deal closure in Q1FY24 has been slow in the transportation segment and affects revenue growth. The management is hopeful of an accelerated deal pipeline closing in the next two quarters.

- The media and communication segment is witnessing a slowdown, affecting revenue growth.

- The healthcare division recorded a sequential growth of 3.4%, a significant improvement over the last two quarters. The company is hopeful to continue the growth momentum in subsequent quarters on the back of good new deals and product wins.

- Operating margins fell 341 basis points sequentially in Q1FY24 to 27.05%, owing primarily to higher employee costs and subcontracting expenses. However, management expects that margins will improve in the coming quarters. This will be driven by increasing employee utilization from 72.5% to 80% and decreasing subcontracting expenses.

- In FY24, the company plans to hire 1800-2000 employees, and despite the uncertain demand outlook, the management is hopeful of strong deal wins and client transformation in the industry.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

Is Tata Elxsi the same as TCS?

No, TCS and Tata Elxsi are different companies with different domain expertise. Tata Elxsi is a product development company n the automotive, healthcare, and media & communications industries. TCS is an IT services company.

How has Tata Elxsi share price performed in the last five years?

As of 27th April 2023, Tata Elxsi share price has given a CAGR return of 45% and 79% in the last five and three years respectively. It made an all-time high level of ₹10,760 in August 2021.

When was Tata Elxsi established?

Tata Elxsi was incorporated on 5th May 1989 in Bangalore and is primarily involved in the development and promotion of electronics, embedded systems, and software applications.