Introduction:

A company’s financial performance shows how well it uses its assets, earns money, and runs its business. Simply put, it reveals how healthy and financially stable it is. But how do we analyze that? Some important financial ratios and metrics help assess if a business meets industry standards or falls short in profiting. One metric stock market advisory company and investors often rely on is the ROE. What is it, and why is it essential when analyzing companies? Let’s find out.

What Is The Concept Of ROE?

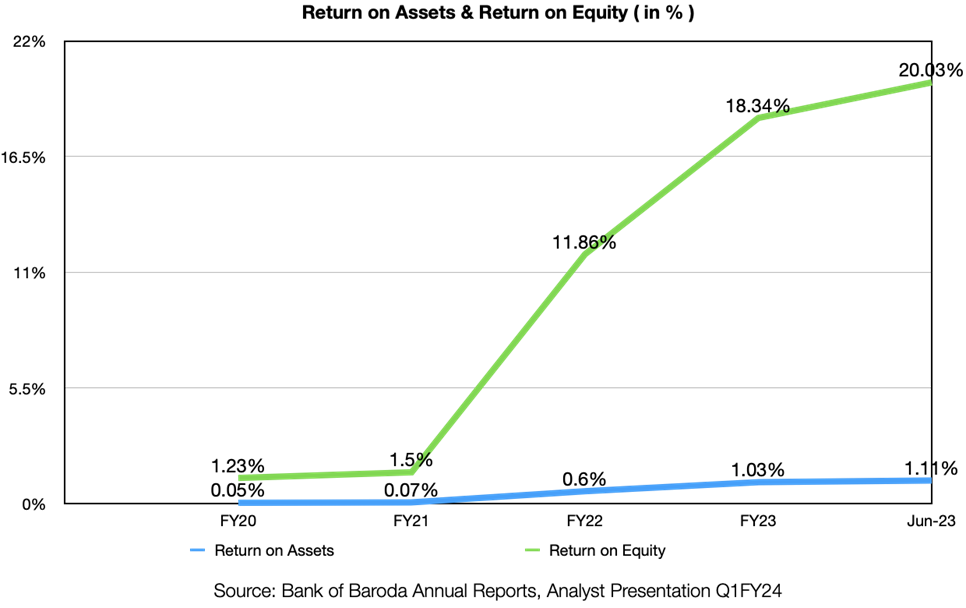

ROE is a primary part of the answer to the question, “What is fundamental analysis?” The return on equity (ROE) ratio measures how well a company generates profits from its shareholders’ investments. Simply, it shows how much profit is earned for every rupee of equity. For instance, an ROE of 1 means that every rupee of equity generates 1 rupee of net income. This is a crucial metric for potential investors, highlighting how efficiently a company uses its money to earn profits.

ROE also reflects how effectively the management utilizes equity financing to run operations and grow the business. Unlike other return-on-investment ratios, ROE focuses on profitability from the investor’s perspective. It calculates the earnings generated based on the shareholders’ investment, not the company’s investment in assets or other areas.

Investors prefer a higher ROE as it shows the company is making the most of its funds. However, ROE should be evaluated within the same industry since industries have varying investment requirements and income levels. Comparing ROE across different industries may thus lead to inaccurate insights.

How Is ROE Different From ROCE and ROA?

Though all three are profitability ratios, the three differ in the following manner-

| Aspect | ROA (Return on Assets) | ROE (Return on Equity) | ROCE (Return on Capital Employed) |

| Focus | Profitability from total assets | Profitability from shareholders’ equity | Profitability from combined capital (debt + equity) |

| Formula | Net Income / Average Total Assets | Net Income / Average Shareholders’ Equity | EBIT / (Total Assets – Current Liabilities) |

| Indicates | How effectively do assets generate earnings | How well shareholder investments generate profits | How efficiently capital is used to generate operating profits |

| Preferred-Value | Higher indicates better asset utilization | Higher indicates greater equity financing efficiency | Higher indicates optimal use of both debt and equity |

| Usage | Evaluates management’s ability to convert assets into profit | Evaluates profitability from shareholder investments | Evaluates operational efficiency with available capital |

| Considerations | Independent of capital structure; useful for asset-heavy industries | Impacted by financial leverage, higher equity lowers ROE | Reflects holistic profitability, blending debt and equity |

| Ideal Application | Comparing asset-heavy companies or assessing operational efficiency | Assessing return for equity investors | Evaluating businesses with significant debt and equity mix |

How To Calculate ROE?

The ROE formula used to calculate the return on equity is

ROE = (Net Income / Shareholders’ Equity) x 100

Here,

- Net income is a company’s profit after subtracting all expenses, taxes, and interest. It shows the company’s overall financial performance.

- Shareholders’ equity is the company’s net worth, the difference between total assets and total liabilities. It represents what shareholders own in the company after debts are paid.

For instance, assume that company A has a net income of Rs.50,00,000 and the shareholder’s equity comes to Rs.2,00,00,000. In that case, the ROE would be

ROE = (5000000/20000000) x 100 = 25%

25% ROE means the company generated Rs.0.25 or 25 paise profit against every Re.1 of the shareholder’s equity.

The ROE can also be calculated using these three different variations of the basic formula-

- To find the return on common equity (ROCE), subtract preferred dividends from net income and divide by common equity. The formula is:

ROCE = (Net Income – Preferred Dividends) / Common Equity

For instance, say a company has a net income of Rs.10 lakh, preferred dividends of Rs.2 lakh, and common equity of Rs.50 lakh. The ROCE for this variation will be

ROCE = (1000000 – 200000) / 5000000 = 0.16 or 16%

- Another way is to divide net income by the average shareholder equity. To calculate average shareholder equity, add the equity at the start of a period to the equity at the end and divide by two.

So, if a company has a net income of Rs.8 lakh, and the shareholder equity at the start of the year is Rs.40 lakh, and at the end of the year is Rs.60 lakh, the ROCE will be

ROCE = Net Income / Average Shareholders’ Equity = 800000/5000000 = 0.16 or 16%.

- You can also track changes in ROE over a specific period. Start by using the shareholders’ equity at the beginning of the period as the denominator to calculate the starting ROE. Then, use the shareholders’ equity at the end of the period to find the ending ROE. For instance, A company starts the year with equity of Rs.30 lakh and ends the year with Rs.40 lakh.

Net income for the first half is Rs.6 lakh. So, starting ROE = 6,00,000 / 30,00,000 = 0.20 or 20%.

Net income for the second half is Rs.4 lakh. Then the ending ROE = 4,00,000 / 40,00,000 = 0.10 or 10%.

The drop in ROE from 20% to 10% shows declining profitability over the year. Comparing these figures shows how profitability has changed during the period.

ALSO READ:

Further Breaking Down The ROE With DuPont Formula:

In addition, you can use the DuPont formula to break down the ROE components further and analyze them in detail. ROE shows how efficiently a company uses shareholders’ capital, calculated by dividing net income by shareholders’ equity.

The DuPont analysis takes this a notch higher, highlighting which financial activities most impact ROE. This information helps compare the efficiency of similar companies and helps managers spot strengths or areas for improvement.

The DuPont formula is-

ROE = (net income / sales) x (sales / total assets) x (total assets / shareholder’s equity)

In this, the ROE is divided into three ratios that denote the different aspects of ROE-

- Net Profit Margin (net income/sales): Measures operational efficiency as net income generated per rupee of sales.

- Total Asset Turnover (sales/total assets): This shows how well assets are used to generate sales.

- Equity Multiplier (total assets/shareholder’s equity): Evaluate the financial leverage used by the company.

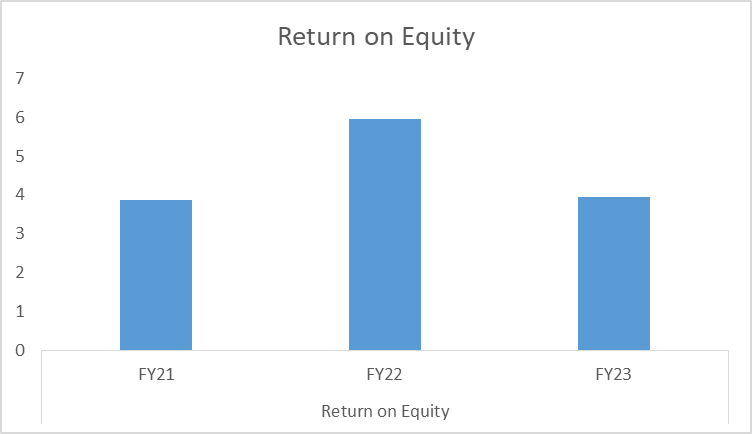

How To Interpret ROE?

Compare ROE with Industry Averages

Look at a company’s ROE compared to its industry average. A higher ROE suggests that the company efficiently uses shareholders’ equity to generate profits. Take TCS’s ROE, for instance. The company reported an impressive ROE of 51.04% in FY2024, far exceeding the IT industry’s average of 18%. This highlights TCS’s strong profitability and efficient capital use compared to its peers. On the other hand, a lower ROE could mean the company struggles to stay competitive.

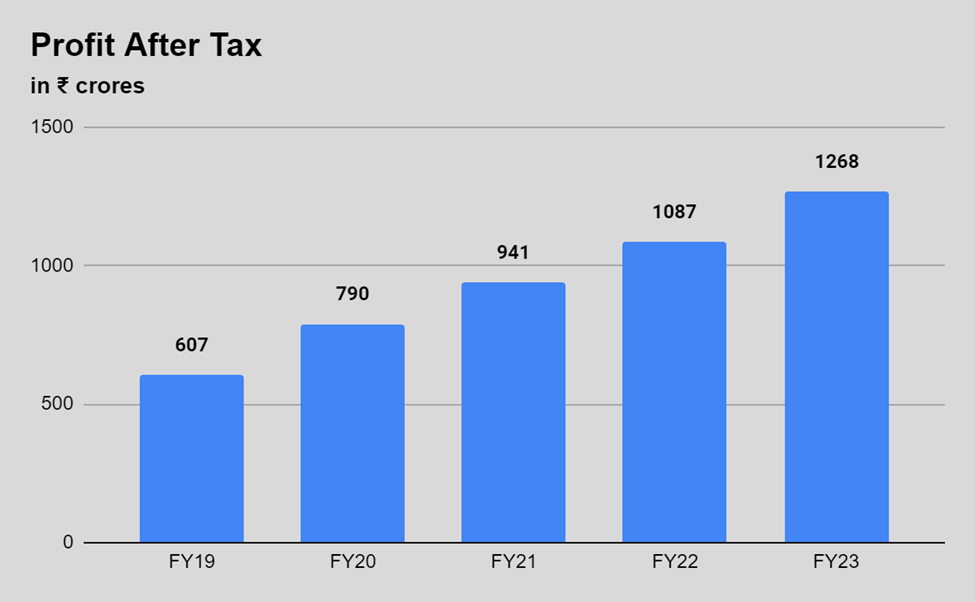

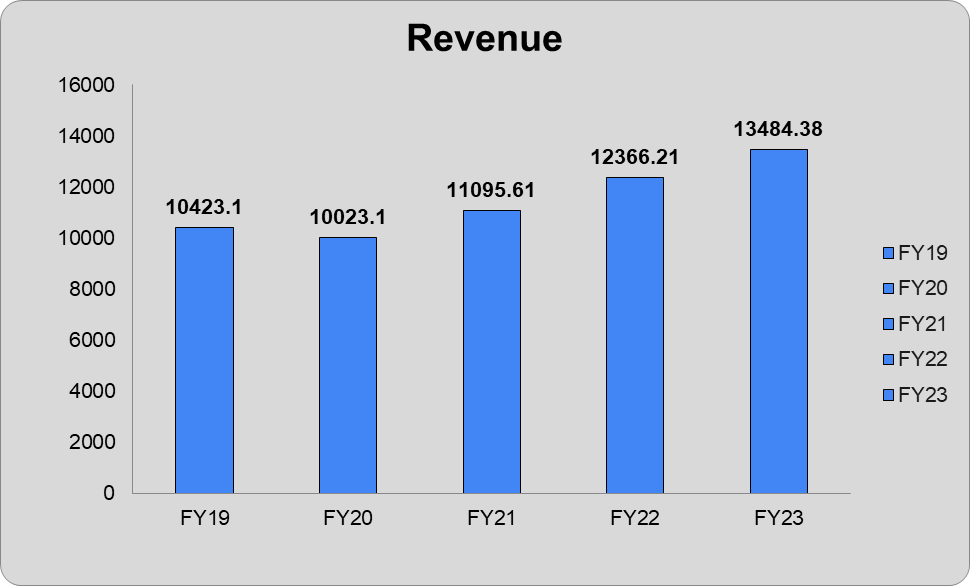

Analyze ROE Trends Over Time

Check how a company’s ROE has changed over the years. A steady rise in ROE is usually a positive sign, showing consistent profit growth for shareholders. But, if ROE fluctuates or declines, it might signal issues that need deeper investigation.

The Ideal ROE

There is no one-size-fits-all number. The ideal ROE depends on the industry and the company’s specific situation. An ROE of 15% or higher is often considered healthy. Comparing it with peers clarifies the assessment.

ROE offers a reliable snapshot of a company’s financial performance, but context matters. A stable ROE suggests that the company effectively uses equity to generate profits. Still, external factors like market dynamics and economic conditions can impact ROE. So, always evaluate ROE alongside other financial ratios and indicators for a clearer picture.

Bottomline:

Think of ROE as a tool to spot industry leaders. A high ROE often indicates strong profit potential. But don’t rely on it alone—constantly evaluate all aspects of a company before investing. ROE, which can be easily calculated using a financial calculator, is one of many metrics used to assess a company’s performance, growth potential, and financial stability. Growth prospects are crucial in judging profitability, so it is important to scrutinize them. The return on equity ratio and other financial ratios can help gauge a company’s potential. Make sure to use them wisely when making investment

Related Posts

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQ

What does a negative ROE indicate?

A negative ROE signals problems with debt, asset retention, or both within the organization.

What does a company with a high ROE signify?

Companies with high ROE generate significant profit relative to shareholders’ equity, efficiently using investors’ money. They excel in retaining earnings, reinvesting them as working capital, and reducing reliance on debt. High-ROE companies often outperform competitors due to advanced technology, efficient operations, or strong branding, helping them generate more earnings than peers.

How is ROI different from ROE?

ROI measures the overall return on your investment, giving a broader financial perspective. ROE, however, zooms in on the returns shareholders earn based on their equity in a company.