The inauguration of Donald Trump as the 47th President of the United States has set the stage for significant economic and policy shifts. As the world watches, markets have already started responding, and Indian professionals in the US are bracing themselves for potential changes in trade, regulation, and immigration policies. But what does this mean for global markets, especially India’s economy? And how will Trump’s policy agenda impact Indian professionals working in the US?

Market Reactions to Trump’s Inauguration

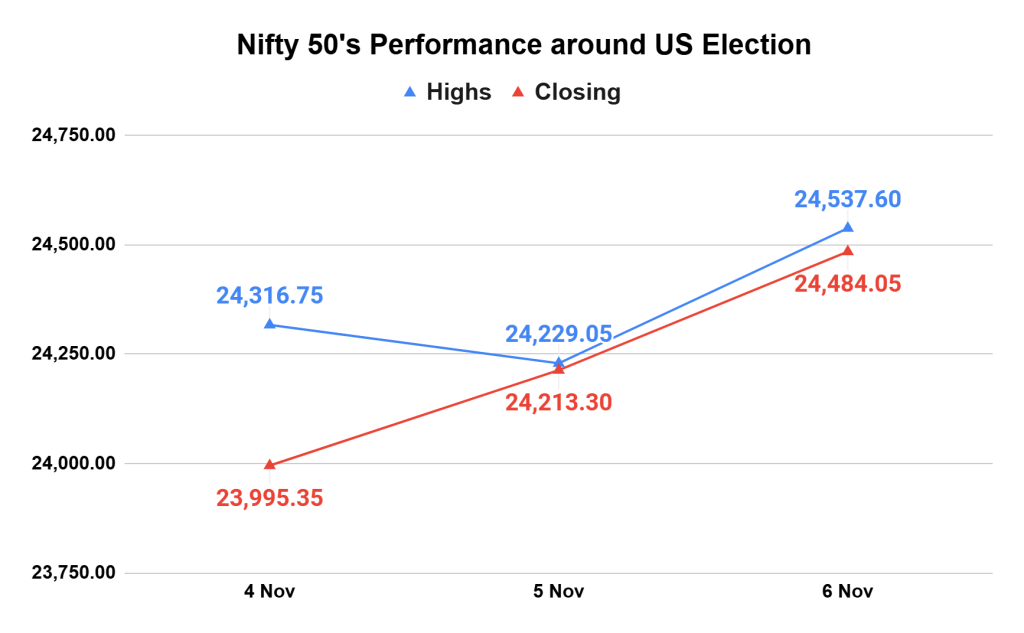

Indian stock markets opened on a positive note ahead of Trump’s swearing-in ceremony. The Nifty 50 index opened at 23,290.40 points, gaining 87.20 points (0.38%), while the BSE Sensex surged by 359.20 points (0.47%), opening at 76,978.53. Market experts suggest that investors are keenly observing Trump’s first executive orders, which will provide insights into his economic agenda for the upcoming term.

Sectoral Impact:

- While sectors such as Nifty Auto, FMCG, and Metal faced declines, others gained traction. Nifty Private Bank surged by 1%, with Kotak Mahindra Bank leading the rally by jumping 7.5%, supported by a 10% rise in quarterly profit. Similarly, Wipro rose 7% after exceeding third-quarter revenue and profit expectations.

Asian markets

- have also shown optimism, driven by hopes of a US-China trade deal and the Israel-Hamas ceasefire being implemented. The Nifty smallcaps and midcaps indices rose by 0.3% and 0.6%, respectively, indicating a broader market uplift. Asian equities climbed in early Monday trading, tracking US peers following a positive conversation between Donald Trump and Chinese leader Xi Jinping ahead of the US President-elect’s inauguration.

- Shares in Australia, Japan, and South Korea gained, while a gauge of US-listed Chinese shares jumped 3.2% on Friday as Trump described the talk between the two leaders as “very good.” US futures were slightly lower in Asian trading with Wall Street closed on Monday due to a holiday. Source: The Tribune

Trump’s Economic Policy Agenda

Trade and Tariffs

Trump’s “America First” policy emphasizes protectionism, focusing on domestic job creation and reducing trade deficits. His proposed tariffs include universal duties ranging from 10% to 20% on all imports, with up to 60% tariffs on Chinese goods, and 25% tariffs on imports from Mexico and Canada. These measures are expected to have far-reaching consequences:

- Increased inflation and a stronger US dollar make exports less competitive.

- Pressure on global supply chains, especially in the automotive and technology sectors.

- Potential market volatility as investors weigh long-term consequences against short-term gains.

Analysts expect a phased implementation to allow businesses to adjust, though concerns remain regarding the speed and scale of execution.

Regulatory Changes: Energy and Financial Sectors

One of the key focus areas of the new administration is deregulation, which is likely to impact both the financial and energy sectors significantly.

- Financial sector: Trump is expected to roll back stringent regulations imposed under the previous administration. This move is anticipated to benefit banks by reducing compliance costs and increasing profitability. Investor optimism has already rallied financial stocks, reflecting positive sentiment around the sector’s growth potential.

- Energy Sector: Trump’s policies may include easing restrictions on oil and gas exploration on federal lands, lifting a pause on liquified natural gas (LNG) exports, and scaling back environmental regulations. These measures could make operations more cost-effective for energy firms, boosting US energy exports. However, long-term sustainability concerns remain.

- Cryptocurrency Market: The cryptocurrency market is closely watching Trump’s administration. There are expectations that executive orders may introduce crypto-friendly policies, providing much-needed regulatory clarity. If implemented effectively, this could lead to increased investment in the crypto market, though some experts remain cautious about speculative volatility. Source: Business Insider

Immigration Policies and Impact on Indian Professionals

A major area of concern for Indian professionals in the US is the anticipated shift in immigration policies. Key areas of impact include:

- H1B visa policies: Potential tightening of eligibility criteria and prolonged processing times.

- Green card approvals: Increased uncertainty surrounding backlog reduction and priority allocations.

- Work visa extensions: Stricter compliance checks may add challenges for existing visa holders.

With growing uncertainty, many Indian professionals are exploring alternative destinations such as Europe and Canada. Despite concerns, industry experts suggest that Indian IT firms have been proactively strengthening their local hiring strategies to minimize risks associated with policy changes. In the long run, while challenges exist, the Indian IT sector remains confident in adapting to the evolving landscape. Source: Economic Times

Cryptocurrency: The Rise of $TRUMP Coin

In an unexpected move, Trump has ventured into the cryptocurrency market by launching the $TRUMP coin. The digital asset debuted with a market capitalization of $9 billion, peaking at $15 billion, with the price surging over 300% within days of its release. Currently valued at around $46, the meme coin is hosted on the Solana blockchain, with an initial supply of 200 million tokens is expected to expand to 1 billion over the next three years. While excitement is high, market analysts remain cautious about its long-term viability. Source: Forbes

Looking Ahead: Challenges and Opportunities

As Trump’s policies take shape, their impact on the global and domestic markets will become clearer. Investors are closely watching trade, immigration, and financial regulation changes to assess long-term economic prospects.

For Indian professionals in the US, the evolving policy environment presents challenges and opportunities. While sectors such as technology and finance may find new avenues for growth, concerns over stricter immigration policies persist. The road ahead remains uncertain, but adaptability and strategic planning will be key to navigating these changes.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.