Central Depository Services Limited (CDSL) shares saw a sharp drop of nearly 12% after announcing their third-quarter (Q3) results for the fiscal year. The stock hit a three-month low of ₹1,242.50 on January 28, driven by lower-than-expected Q3 earnings.

CDSL reported a 21.5% rise in consolidated profit after tax, reaching ₹130 crore. Although its year-on-year income demonstrated notable growth, the quarter-on-quarter performance declined.

The company’s weaker performance fell short of market expectations, triggering a sell-off as investors expressed disappointment. Let’s explore the reasons behind this significant dip and what this means for the investors and the broader market.

CDSL’s Q3 Performance

CDSL, one of India’s leading securities depositories, reported lackluster financial results for the quarter ending December 2024. The company’s net profit and revenue growth failed to meet analysts’ estimates, which dampened market sentiment. Here are some of the key highlights of the results:

Strong Year-on-Year Growth, but Quarter-on-Quarter Decline for CDSL

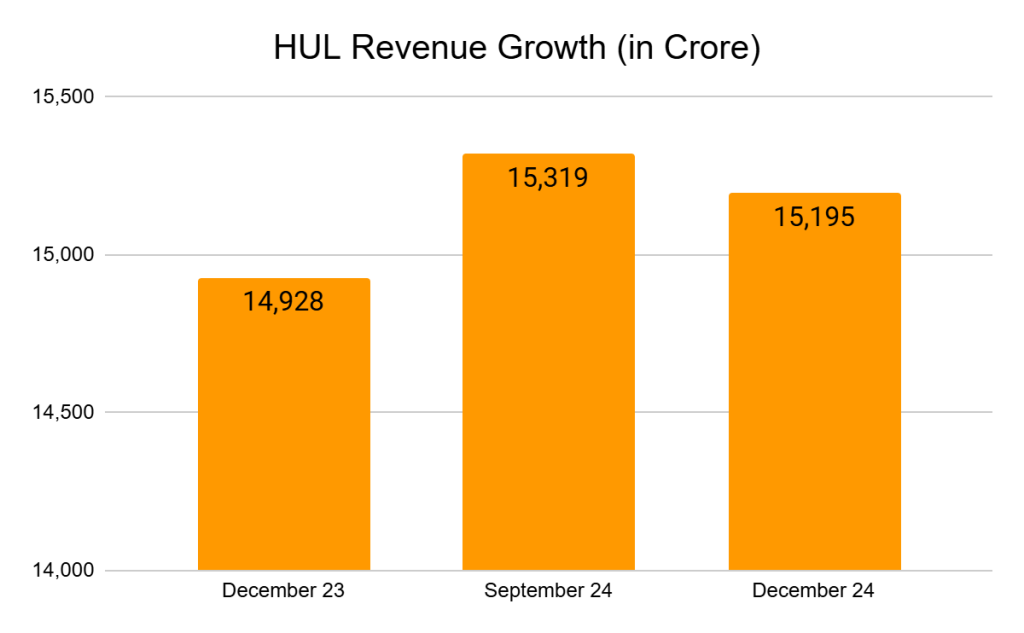

CDSL reported a total income of ₹298 crore for Q3 FY25, reflecting a substantial year-on-year (YoY) increase of 26.3% compared to ₹236 crore in the same period last year.

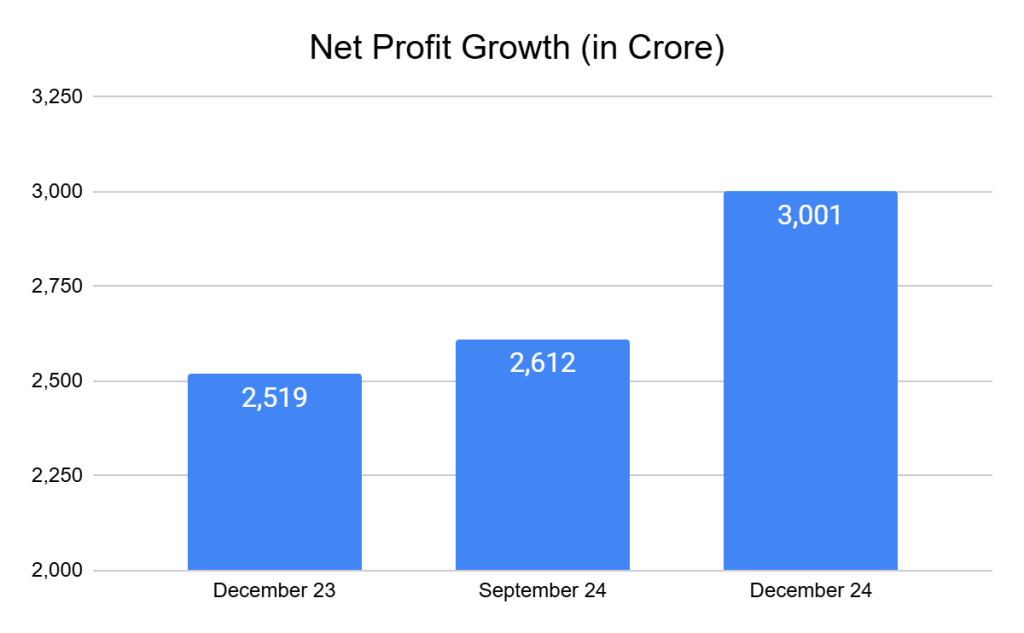

On a standalone basis, the net profit for Q3 FY25 was ₹105 crore, reflecting a year-on-year (YoY) growth of 22.09%. However, it recorded a quarter-on-quarter (QoQ) decline, falling to ₹278 crore for the quarter ending December 2024, compared to ₹322 crore in the September 2024 quarter. Source: Economic Times/Screener

The profit also declined to ₹130 crore in the December 2024 quarter, compared to ₹162 crore in the September quarter, reflecting a 20% decrease. Source: Moneycontrol

Additionally, the number of net new demat accounts opened during the quarter was the lowest since Q4 FY24. New account openings in Q3 stood at 92 lakh, a decline from the 1.18 crore accounts added in September. Source: Moneycontrol

Market experts attributed the sell-off to several factors:

Earnings Miss:

The failure to meet earnings expectations was the primary driver behind the negative sentiment.

High Valuations:

CDSL’s stock was trading at relatively high valuations before the results, which magnified the impact of the earnings disappointment.

Sectoral Weakness:

Broader concerns about the depository sector, including regulatory changes and market activity levels, added to the pressure on the stock.

CDSL: A Pillar of India’s Market Infrastructure

CDSL plays a vital role as an Indian Market Infrastructure Institution (MII), enabling electronic holding and securities transactions while facilitating trade settlements. It serves many capital market participants, including depository participants, issuers, investors, RTAs, clearing corporations, and exchanges.

As India’s leading depository services provider, CDSL is globally recognized as the only listed depository in Asia, managing over 14.65 crore accounts.

CDSL Share Price Performance

In the past year, CDSL’s shares have risen by 54.85%. Over the last six months, the stock gained 12.03%, but it faced a minor decline of 3.41% in the past three months. However, CDSL’s returns dropped sharply by 24.14% in the last month.

What Analysts Say?

Analysts have offered mixed reactions to CDSL’s Q3 performance. While some believe the earnings miss is a temporary blip, others are more cautious about the company’s outlook. Here’s what they’re saying:

- Near-Term Challenges: Brokerages highlight that slow revenue growth and margin pressures may continue in the short term due to macroeconomic challenges and regulatory uncertainties.

- Long-Term Potential: Analysts are optimistic about CDSL’s future, which is driven by the growing use of demat accounts and a rising retail investor base in India.

- Target Price Revisions: After the Q3 results, several analysts lowered their target prices for CDSL’s stock. One prominent firm, for example, reduced its target from ₹700 to ₹600, indicating a more cautious approach.

Investor Concerns and Sentiment

The steep drop in CDSL’s stock price has raised concerns among investors, particularly retail shareholders. Many question whether the current dip presents a buying opportunity or if the stock will face further downside.

- Short-Term Uncertainty: The stock’s poor performance and lack of immediate growth triggers may discourage short-term investors.

- Long-Term Growth: Long-term investors might see this dip as a chance to buy at lower prices, supported by strong growth prospects in India’s capital markets.

What Lies Ahead?

CDSL’s ability to navigate the current challenges will determine its trajectory. Key focus areas for the company include:

- Enhancing Operational Efficiency: Streamlining operations and controlling costs will improve profitability.

- Expanding Revenue Streams: Diversifying into new areas, such as value-added services, can help mitigate the impact of fluctuations in core revenue streams.

- Leveraging Market Growth: As India’s capital markets continue to grow, CDSL can capitalize on the increasing investor participation and expanding financial instruments.

Conclusion

CDSL’s Q3 performance has undoubtedly disappointed the market, resulting in a sharp correction in its stock price. While the short-term outlook appears challenging, the company’s strong market position and long-term growth drivers offer hope for a recovery. For investors, the key will be to weigh the near-term risks against the long-term potential before making any decisions.

As always, staying informed and monitoring the company’s performance in subsequent quarters will be essential for making well-informed investment choices.

Know More:

SEBI registers investment advisory | Stock investment advisory

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.