Do you want stocks that can turn 1 lakh into 1 Crore rupees?

And know how to calculate CAGR.

It is very easy to begin investing today. More so, technology and online brokering platforms make it a 5th grader’s job to open an account within a day(s). What’s difficult is staying invested through market volatility. And those who remain invested over the long term can only enjoy the sweet fruits of compounding.

However, there is another daunting task – calculating your compounded return on investments. Though it’s quick to calculate absolute returns, evaluating your compounded returns is the right approach for equities.

Are you wondering why?

You don’t earn simple interest on equities. The stock markets fluctuate so it’s not a place where you will gain consistently. Some days, the markets are up; others are s muted or down.

Moreover, Compound Annual Growth Rate (CAGR) is the best formula for comparing different investments’ performance over time. You can compare the CAGR to gauge how well one stock or your portfolio performed compared to other stocks or a market index.

Get your Compound Annual Growth Rate Basics Right

According to Investopedia, the Compound Annual Growth Rate (CAGR) is the mean annual growth rate of an investment over a specified period of time longer than a year. Using the CAGR formula, you can evaluate and determine returns for individual assets, investment portfolios, and anything that fluctuates (rises or falls) in value over time.

For example, suppose you invested Rs. 1,00,000 at the beginning of 2020, and by year-end, your investment was worth Rs. 2,00,000, that’s a fabulous return of 100%. In 2021, the markets corrected, and your investment plunged to Rs. 1,50,000. So, what is your annual rate of return?

Checking the Annual average return formula won’t work here. The annual average return on this investment is 25% (the average of 100% gain and 50% loss), but in the two years, the investment grew to Rs. 1,50,000 and not Rs. 1,56,250 (i.e. Rs. 1,00,000 for two years at an annual rate of 25%).

Hence, you need to calculate the CAGR to understand your actual annual rate of return.

How to Calculate Compound Annual Growth Rate?

There are two approaches to calculating the CAGR.

- Consider only Capital Gain

- Consider the Total Gain

It may seem difficult, but it is easy to understand. The formula for both approaches remains the same. The change occurs only in the final investment value.

- CAGR = Compound annual growth rate

- t = Time in years

Approach 1.

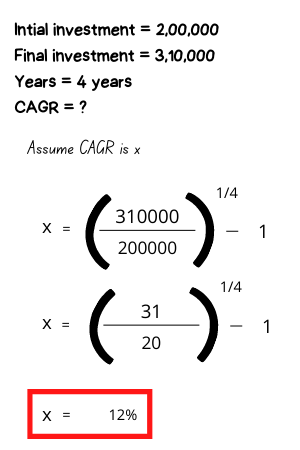

Here is an example to calculate CAGR

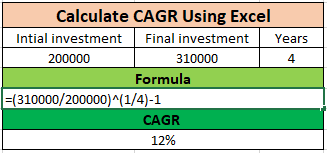

If you are someone who uses spreadsheets a lot, here is a quick peek into calculating CAGR using Excel:

Approach 2.

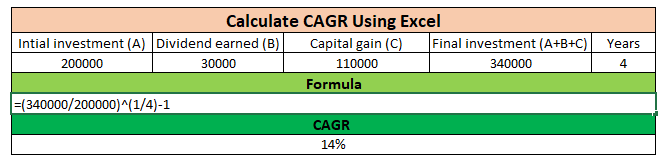

The second approach is the most accurate one to determine the performance of your portfolio. Since the stocks you invest in may also distribute dividends over and above the capital appreciation, it is important to consider the amount earned through dividends when calculating CAGR.

All you need to do is add the sum earned from the dividend to the final investment amount. Here is how to do it using Excel-

Final words

Though CAGR gives you an accurate portfolio performance, it does not display volatility. CAGR is a pro-forma number showing a “smooth” annual yield, so it can create an impression that there is a steady growth rate despite volatility.

Over the last 20 years, NIFTY has grown at a Compound Annual Growth Rate of 15% despite several hurdles, including geopolitical crisis, global financial crisis, financial scams, and COVID-19.

Want a pictorial depiction, click here to download the document.

So, suppose you are wondering whether to remain invested or get out during volatility. In that case, we advise remaining invested long-term, provided you have invested in fundamentally sound stocks. Also, it is prudent to seek the help of a wealth advisor to invest better.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.